Purchase Order – Purchase Price Variance

Overview

This document will serve as an overview of the functionality available via Purchase Orders and the AFP tool to create a purchase order, purchase order receipt, and purchase price variance.

Definition: Purchase Price Variance compares the cost of an item which is coded as having a “Standard” cost type, to the purchase order price. For example, if the item cost = $100.00, and the purchase order price is $133.00, and the quantity received is 1, then the journal entry the would be created is a DR of $100.00 to Inventory, DR of $33.00 to PPV, and a CR of $133.00 to Goods Received, Not Invoiced (GRNI).

Ascent’s AFP module is required to set up the general ledger accounts and posting processes.

Let’s illustrate the set-up, but assume the general ledger accounts have already been created.

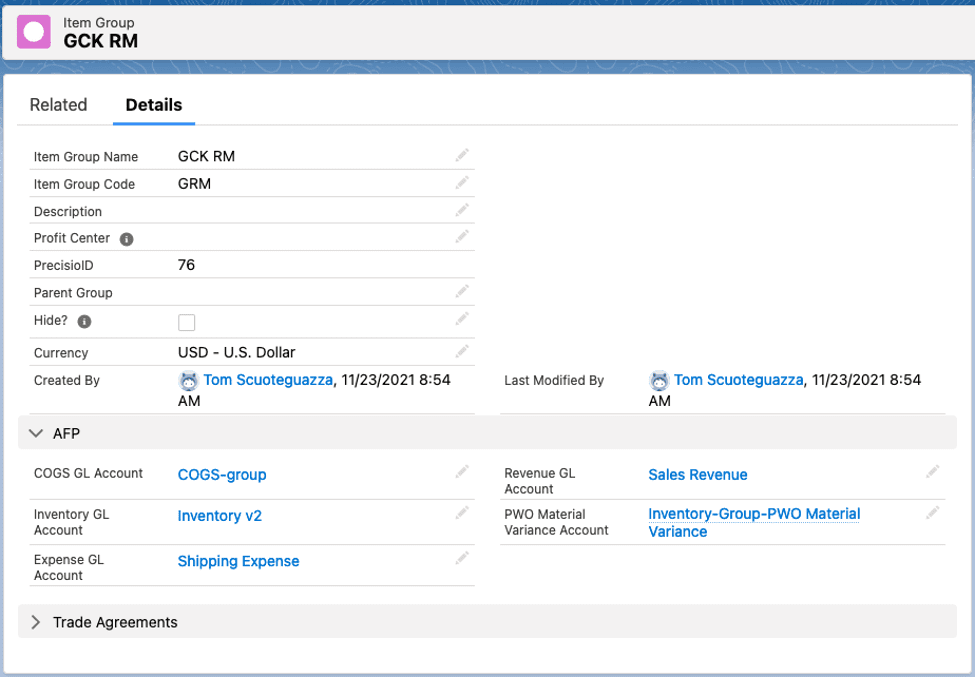

- First, set up the Item Group posting profile. Item Groups are ways that we can categorize items with similar characteristics, like posting accounts, common uses (brass screws, wood screws, etc), and costs.

Here, we’ve set up an item group called GCK RM. To access it, click on the tab entitled Item Groups:

You need an item group name, an up-to-3 character item group code, and the appropriate general ledger accounts. For our example, we require just the Inventory GL Account, but as you can see, it houses other GL accounts for other purposes.

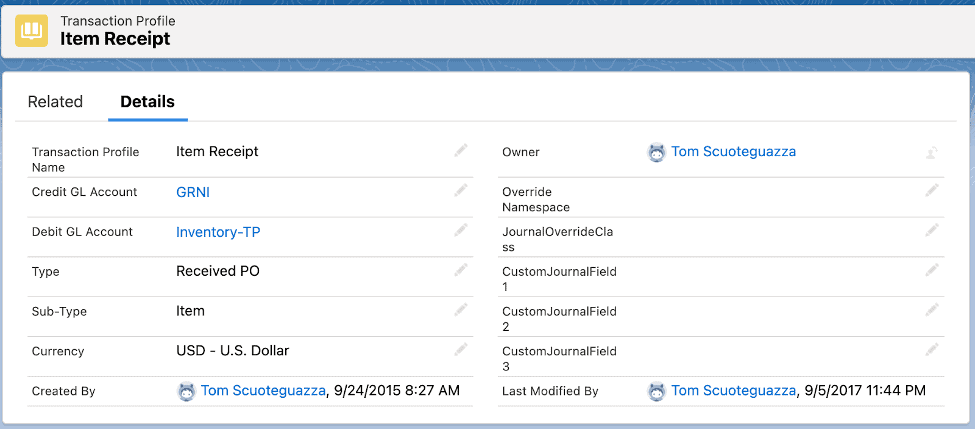

- Next, we need to tell the system what will be our credit for the purchase receipt value. That is known as the Goods Received, Not Invoiced account. To enter that, go to the Transaction Profile tab. You will create the Item Receipt name, with a Type of “Received PO”, a Sub-Type of “Item”, and the Credit GL Account of the goods received, not invoiced. Here, we named ours GRNI. Notice that there also exists a Debit GL Account and we’ve entered Inventory-TP. This would be the default GL account used if you have not entered a general ledger account in the Item Group posting profile.

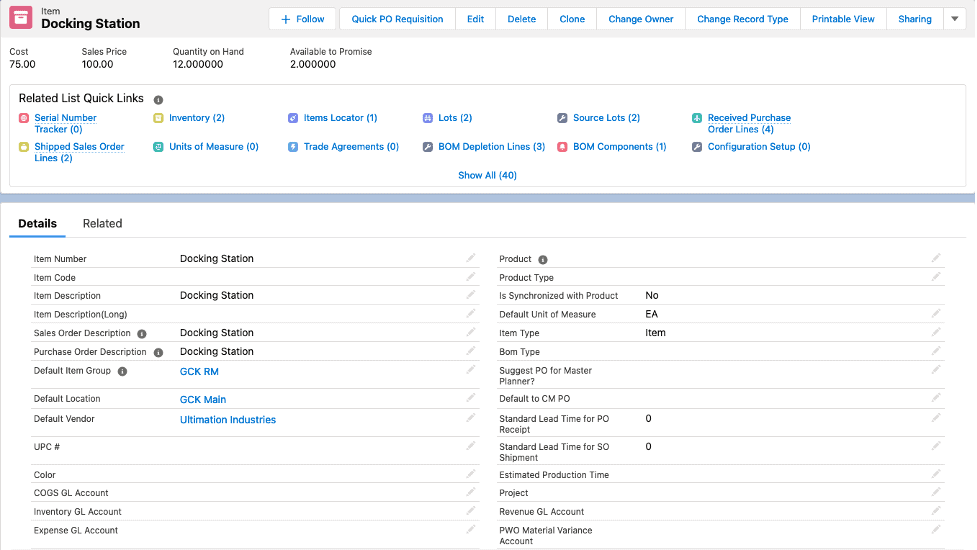

There’s another place where you can put your GL Account, and that’s at the Item Master level. You might have an item (precious metals?) that you wish to have its own inventory account. You can also have those other accounts on the items master that are referenced on the item group. They are referenced at the bottom of the following screenshot:

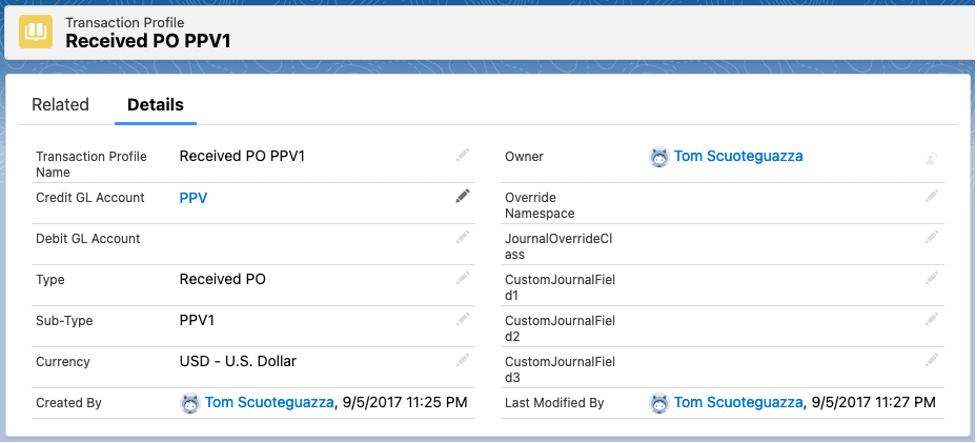

- Lastly, there needs to be a transaction profile for the Purchase Price Variance. Go to the tab called Transaction Profiles and add this one:

Process: To illustrate the creation of purchase price variance journals, we will:

- Create a purchase order with the PO price being different than the cost at standard on the item master

- Perform a PO receipt

- Review the journal that was created

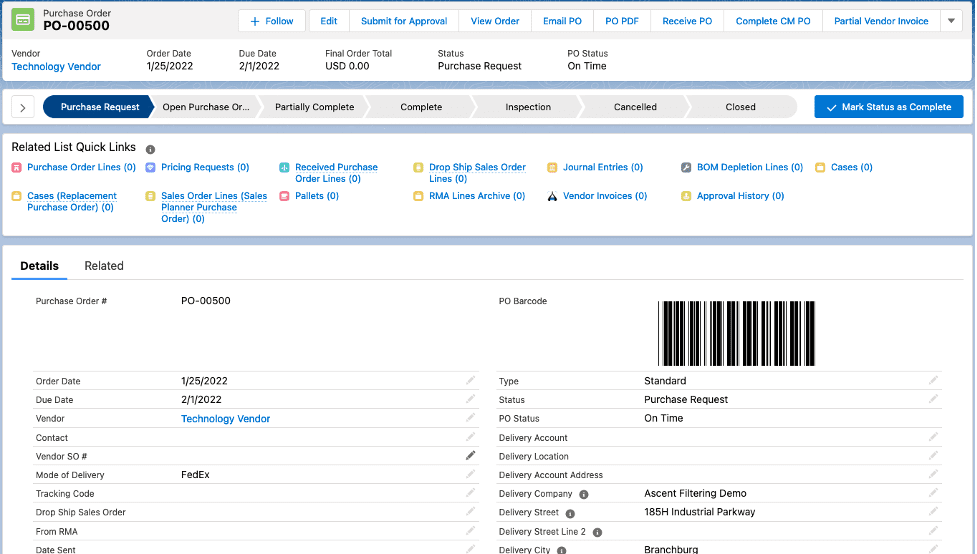

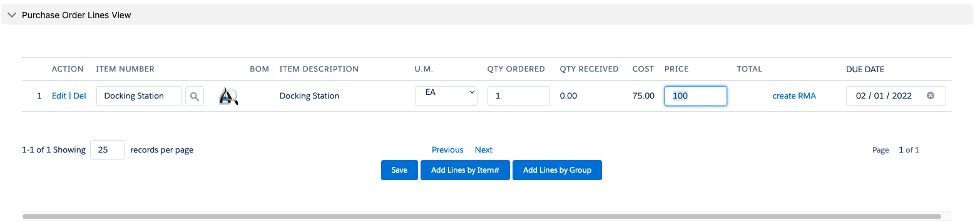

Create the Purchase Order:

We’ll create a simple, one line purchase order. The PO line will be for an item with a cost of $75.00, with a quantity ordered of one (1). However, the price we’ll put on the PO will be $100.00. Go to the tab titled Purchase Order and add a NEW one:

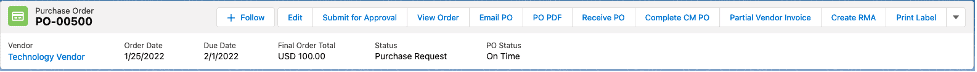

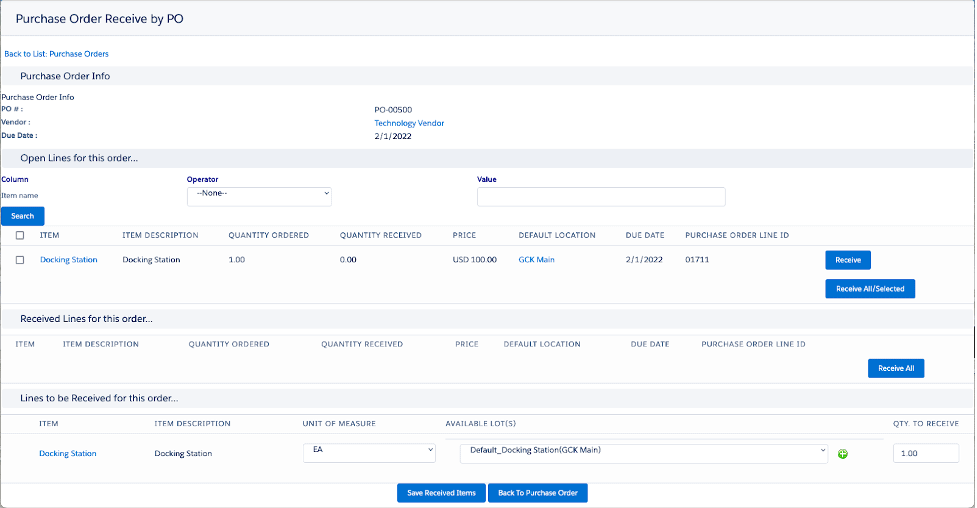

Receive the Purchase Order:

Now, let’s receive the purchase order by clicking Receive PO at the top of the PO screen:

On the next screen, which came up as a result of clicking Receive PO, we clicked the Receive box next to the PO Line, and are now being asked to either select the available lots or create a NEW lot (by clicking the green circle with the + in the middle of it). We’ll accept the default lot/location:

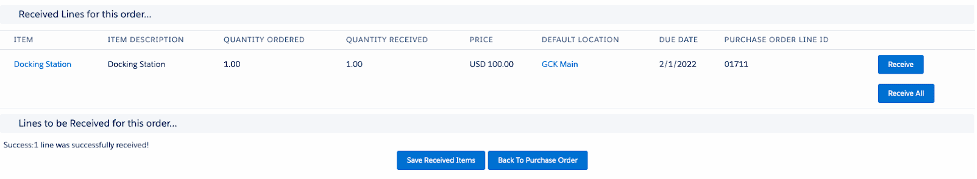

Let’s accept the lot and Qty to Receive and hit Save Received Items, and we will see this response:

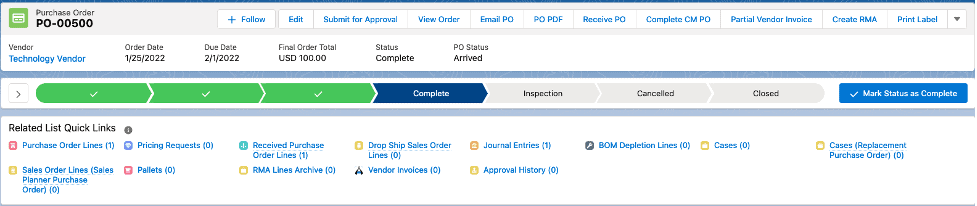

After clicking Back to Purchase Order, we can refresh the screen and look at the Related List Quick Links, where we’ll see Journal Entries (1). Also notice that the status bar has moved to “Complete”:

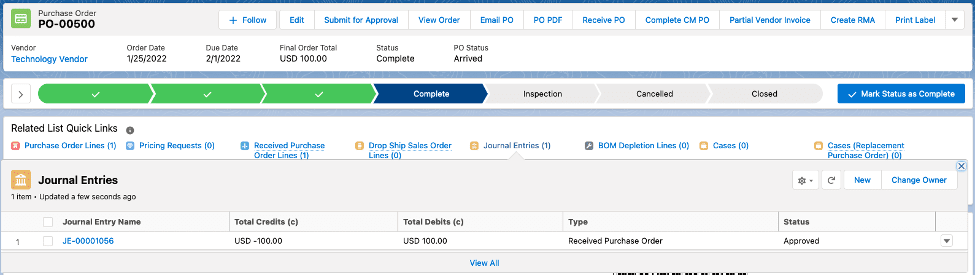

Hover over the Journal Entries (1) field:

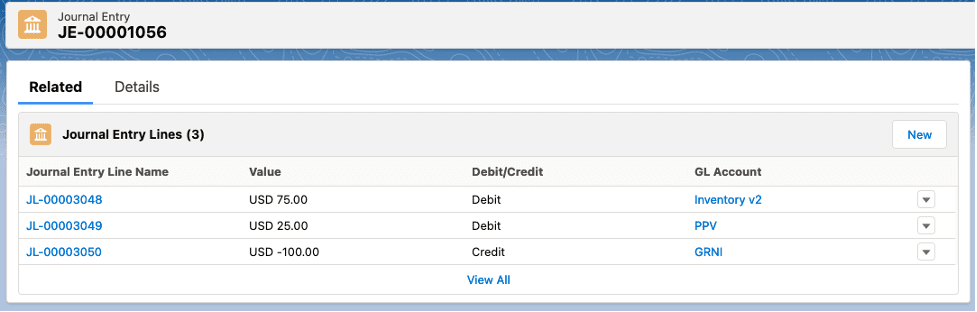

The journal entry that was created is JE-00001056. Let’s click into it:

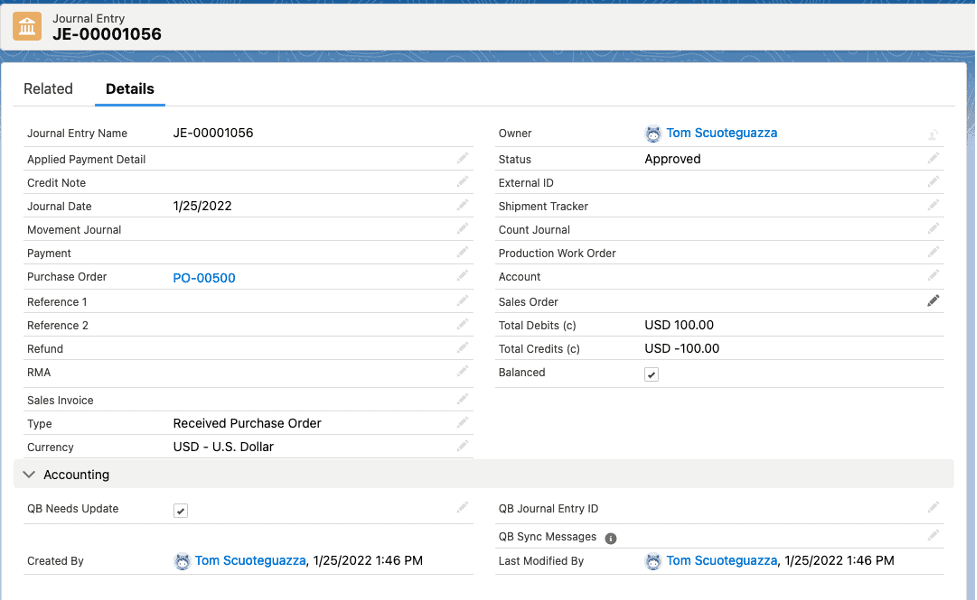

The journal entry has Total Debits of $100.00, and Total Credits of -$100.00. Select Related to see more detail:

You’ll see three (3) journal entry lines. Since this is an item with a standard cost type, the $75.00 is the DR to Inventory. The CR is to Goods Received, Not Invoiced, and that $100.00 is the price on the PO. The $25.00 is the difference between the standard cost and the PO price.