Sales Order – Invoice Journals

Overview

This document will serve as an overview of the functionality available via Sales Orders and the AFP tool to generate journal entries after a sales order is invoiced.

Definition: Journal Entries can occur once a sales order is invoiced. The journal can be quite simple, just debiting the Accounts Receivable account and crediting the Sales Revenue account. But that would assume no tax, no shipping, and no miscellaneous charges.

Ascent’s AFP module is required to set up the general ledger accounts and posting processes.

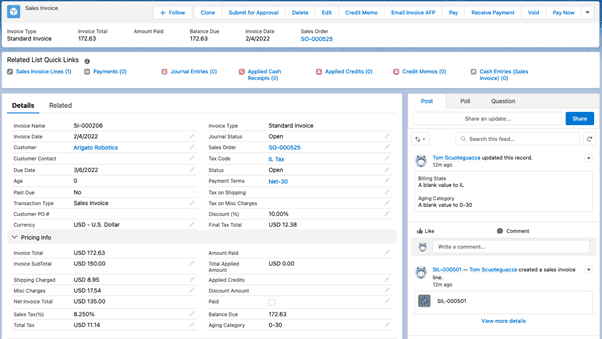

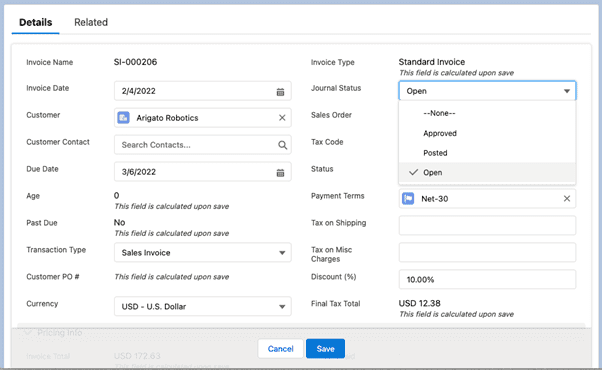

We’re going to use this invoice to illustrate how the journal postings work:

The invoice line:

![]()

For our example, we’ll assume the general ledger accounts have already been created.

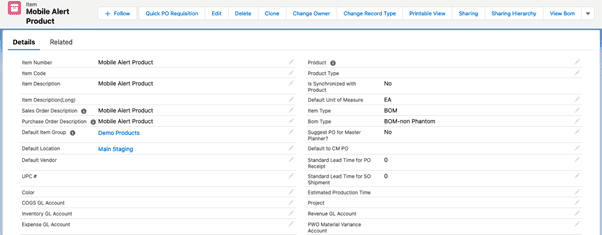

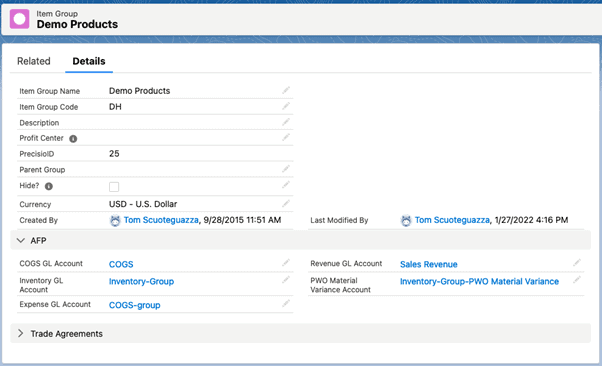

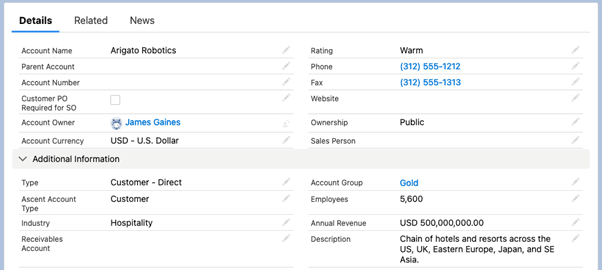

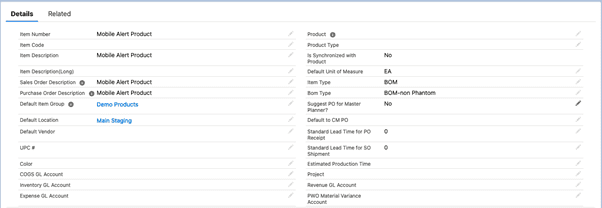

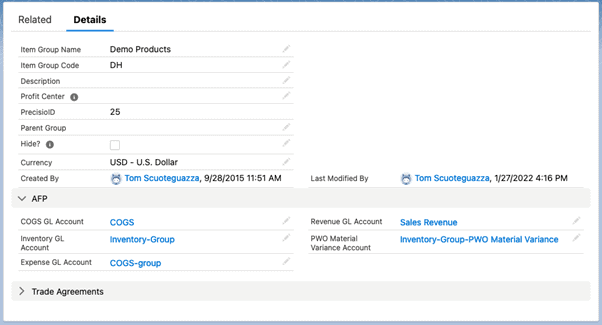

First, set up the Item Group posting profile. Item Groups are ways that we can categorize items with similar characteristics, like posting accounts, common uses (brass screws, wood screws, etc), and costs. If we look at the item, we’ll see the item group is Demo Products:

The item group display:

GL accounts are also available on the item itself, but for this example, our item has blanks in those fields, so they will not be used. The Sales Revenue account from the item group will be used.

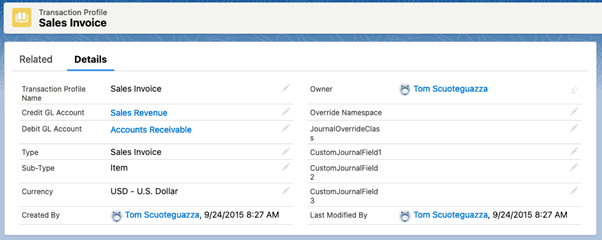

The Accounts Receivable account can come from the Sales Invoice transaction profile. The Sales Revenue account can also come from the Sales Invoice transaction profile. Note: in both cases, this is the Sales Revenue only for sub-type Item, meaning that all other billed amounts on the invoice are not addressed by this transaction profile. They are addressed by other transaction profiles.

Another area where the Accounts Receivable GL account can come from is the Account itself. This would be the first one chosen, if filled in. If blank, the system would revert to the Transaction Profile account.

Similarly, there are other Sales Revenue GL accounts that come before the transaction profile Sales Revenue account on the Sales Invoice / Item transaction profile. First the item:

Next in line is the Item Group:

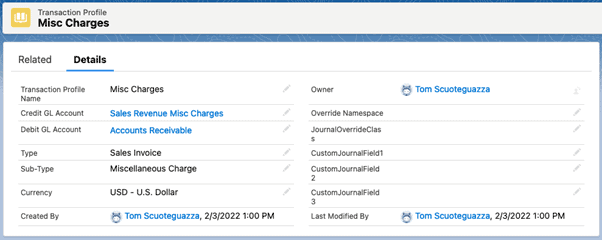

Now, let’s address another area – Miscellaneous Charges. There is a transaction profile which takes care of this:

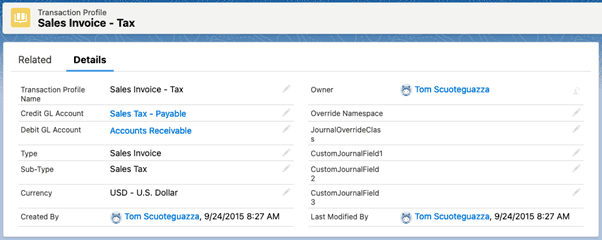

Next, look at Sales Tax. There is a translation profile to handle this. The DR, of course, goes to Accounts Receivable, and the CR, in our case goes to an account called Sales Tax – Payable.

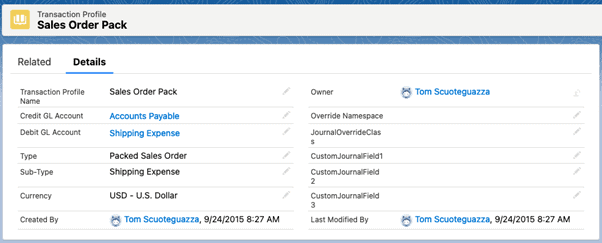

Lastly, let’s deal with the shipping charged to this invoice. Again, there’s a transaction profile to deal with this:

Transaction profiles are NOT created when AFP is first installed, they would have to be manually created, at which point, GL accounts can be entered.

Now, to close out this document let’s state that in order to get the journal entry to actually be created, you have to go to the invoice and click the Journal Status:

To get the journal entry to be created, you must click the “Approved” option. Once you do, the journal status will change to Approved and tne Journal Entries (1) can be hovered over to reveal the journal entry that was just created:

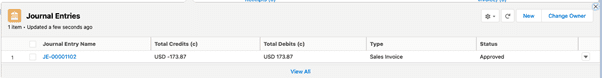

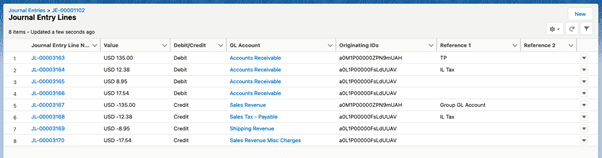

Here are the details of that journal entry:

The DR/CR for USD 135.00 and USD -135.00 is for the line items on the invoice (minus the 10% discount percentage).

The DR/CR for USD 12.28 and USD -12.38 is for the Final Tax Total.

The DR/CR for USD 8.95 and USD -8.95 is for the Shipping Charged.

The DR/CR for USD 17.54 and USD -17.54 is for the Miscellaneous Charges.