Receive Payment – Sales Invoice

Overview

This document will serve to illustrate the receipt of payment against a specific invoice.

Definition: Receiving Payment on the Sales Invoice screen creates cash entries, as well as applied cash receipts records.

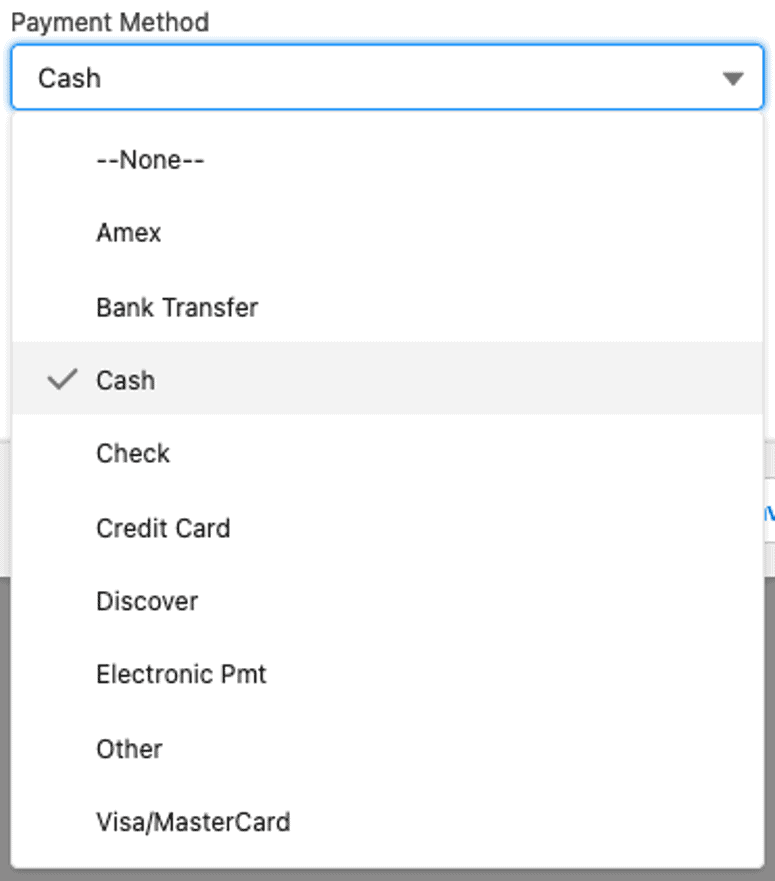

Cash Entries consist of a single record, which records the account who provided the payment, the amount, the payment method (cash, Amex, bank transfer, check, credit card, Discover, electronic payment, Visa/MasterCard, or Other. Those payment methods come under the Payment Method field.

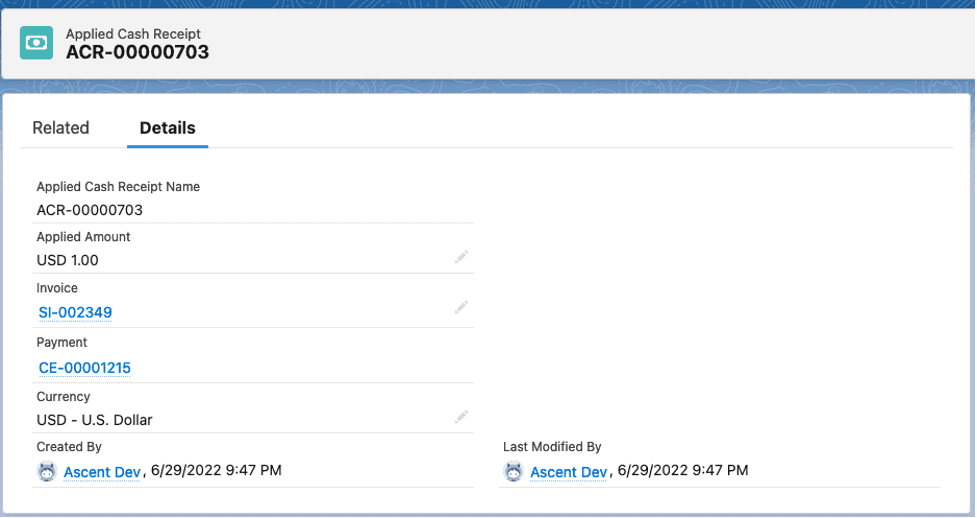

The Applied Cash Receipts record consists of the amount applied, the sales invoice it was applied to, and the cash entry/payment itself.

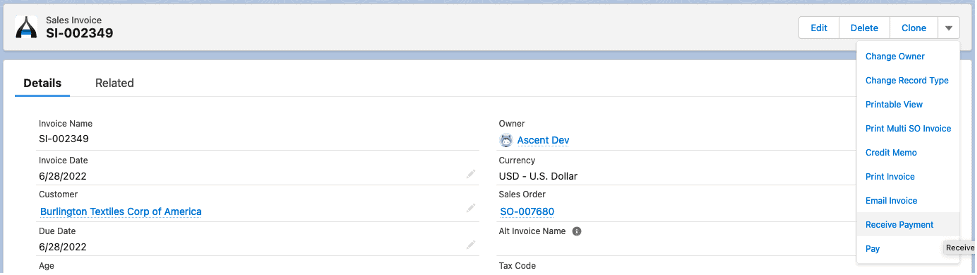

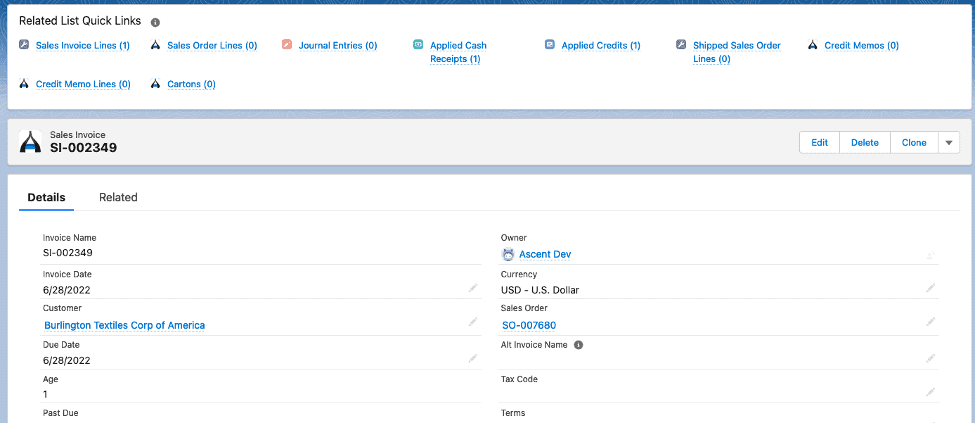

Process: to receive payment, go to the tab labeled “Sales Invoices” and select the sales invoice you wish to post payment to. Once you get your desired sales invoice, click the down arrow to the right of the Clone button on the upper right hand portion of the screen:

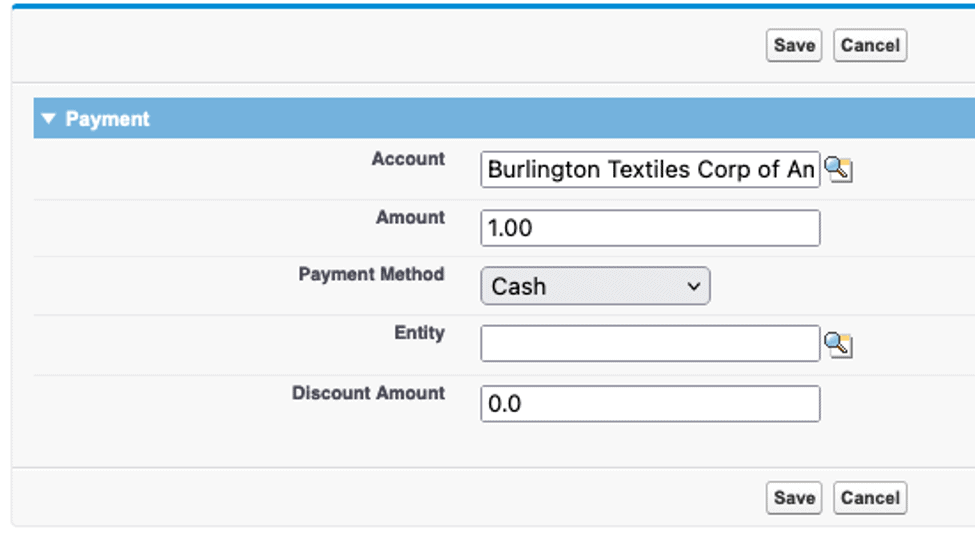

The following fields are available for entry/display, based on what your company has chosen to expose for use.

- Account – the account will be defaulted to from the sales invoice, although you could search anyway.

- Amount – this is the amount of the payment

- Payment Method – you can choose from the drop down list of available payment methods:

- Entity – this would be the entity of the payment received.

- Discount Amount – if there is a cash discount given by the supplier/vendor, that can be entered here. If there is none, pass by the field

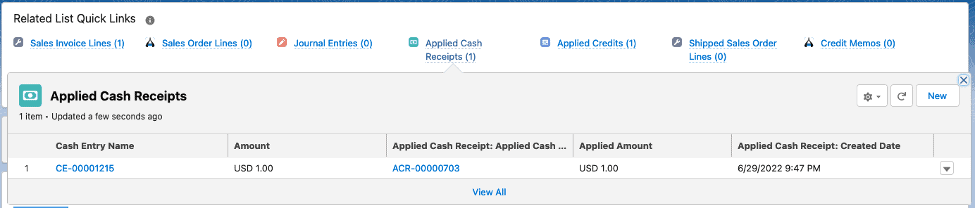

After entering this information, hit Save. You will be brought back to the Sales Invoice screen:

Note: since the payment was received directly to the sales invoice, you will see it appear as an Applied Cash Receipt. The Applied Credits Quick Link relates to a credit memo that was applied to this sales invoice.

The Applied Cash Receipt record looks like this:

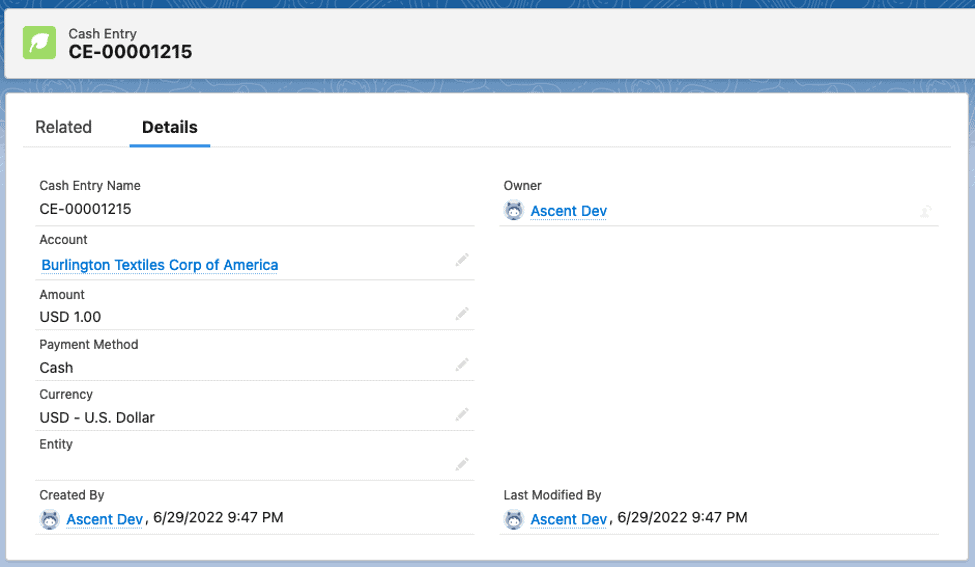

The Cash Entry looks like this: