Transaction Profiles

Overview:

Ascent Financial Platform Transaction Profiles are the “last stop” for obtaining general ledger accounts for Ascent transactions that create journal entries.

The general format is as follows:

Transaction Profile Name: this is the name your company has given to this transaction profile. It is completely user defined.

Debit GL Account: this should be the account that receives the debit when the transaction occurs.

Credit GL Account: this should be the account that received the credit when the transaction occurs.

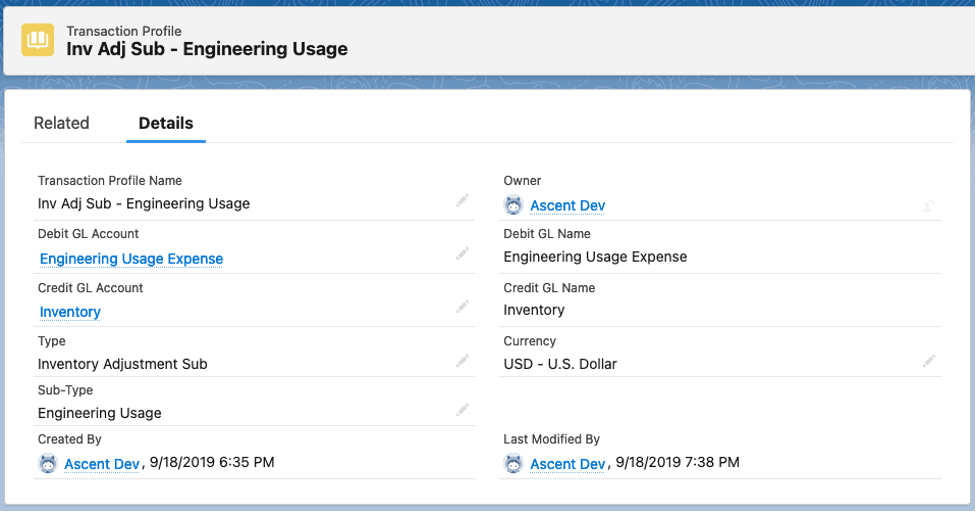

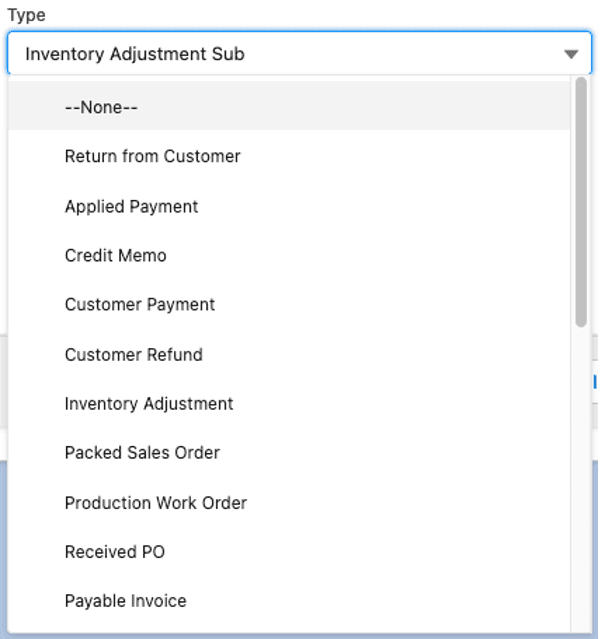

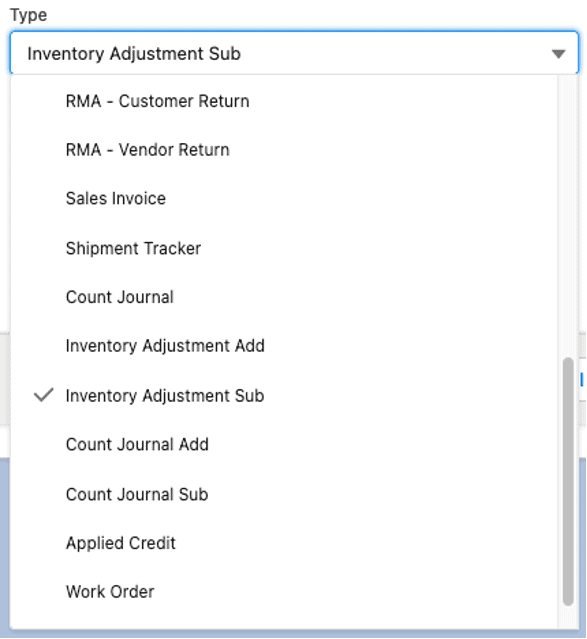

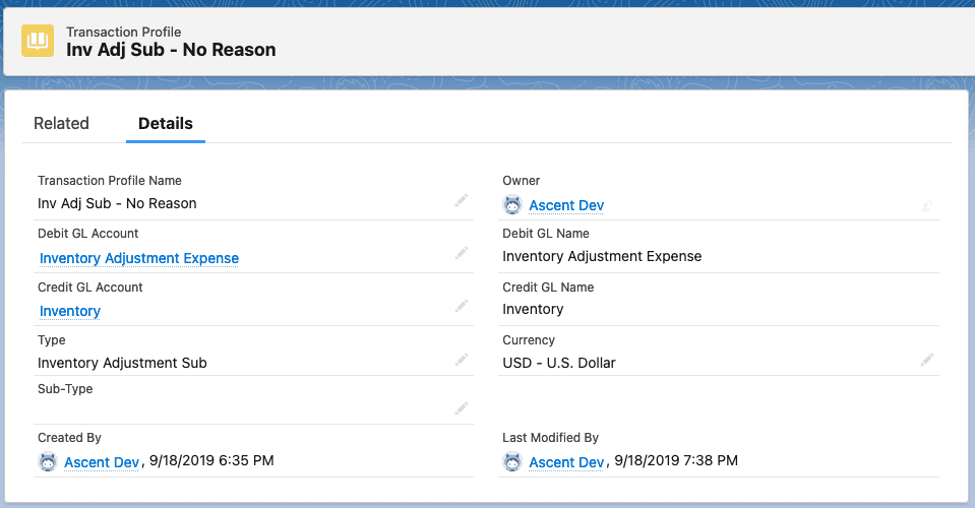

Type: this is the type of transaction. In this example above, the translation profile is required to perform an inventory adjustment – subtract function. If there is no inventory account on the item master or no inventory account on the item group, then the general ledger account referenced in Credit GL Account will be used for the journal line.

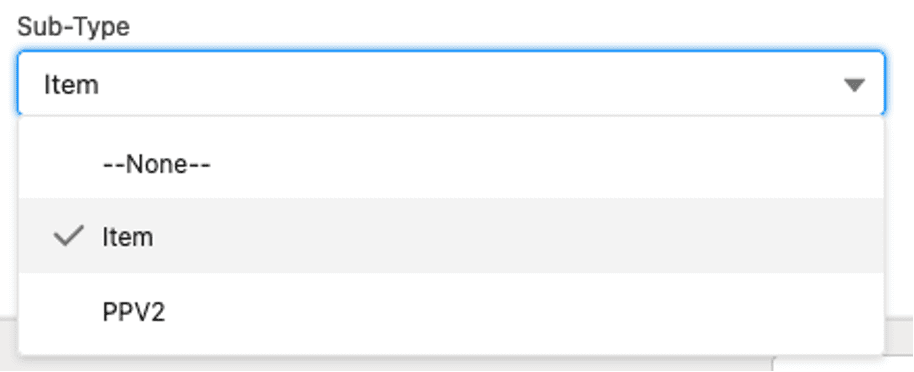

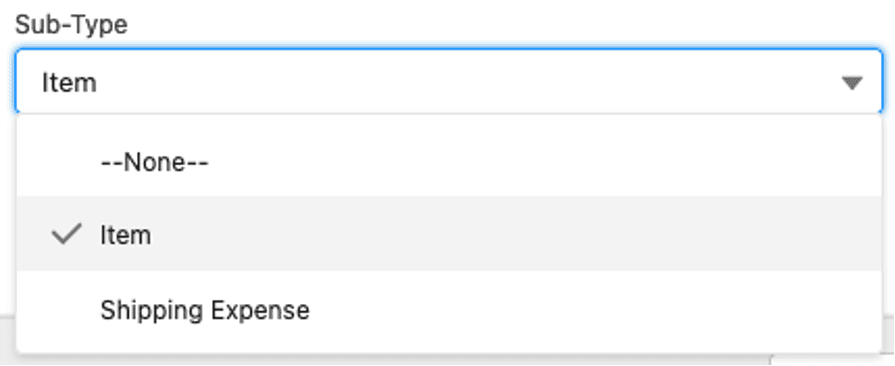

Sub-Type – this further clarifies which accounts can be used. In some cases, this field can be blank. A good example of when it is used would be the example above.

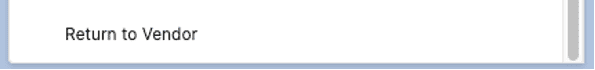

A good example of when it can be left blank is below:

In this example, when performing an inventory adjustment – sub, and you do not enter a reason code, the system will take this transaction profile. If the reason code selected is Engineering Usage, the system will use the first example.

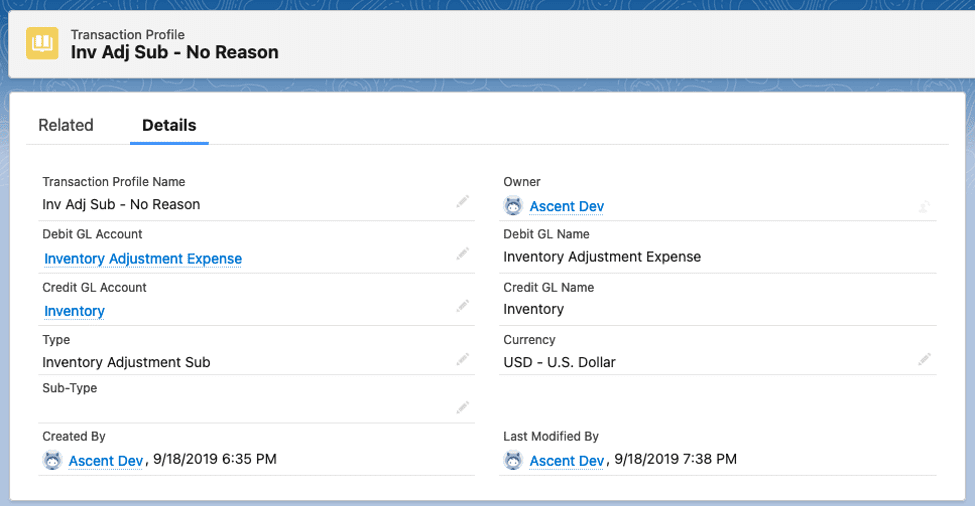

The next two examples are for cash receipts – one for a Discover credit card, and one for the rest of the credit cards. If the credit card chosen for the cash received is Discover, use this transaction profile:

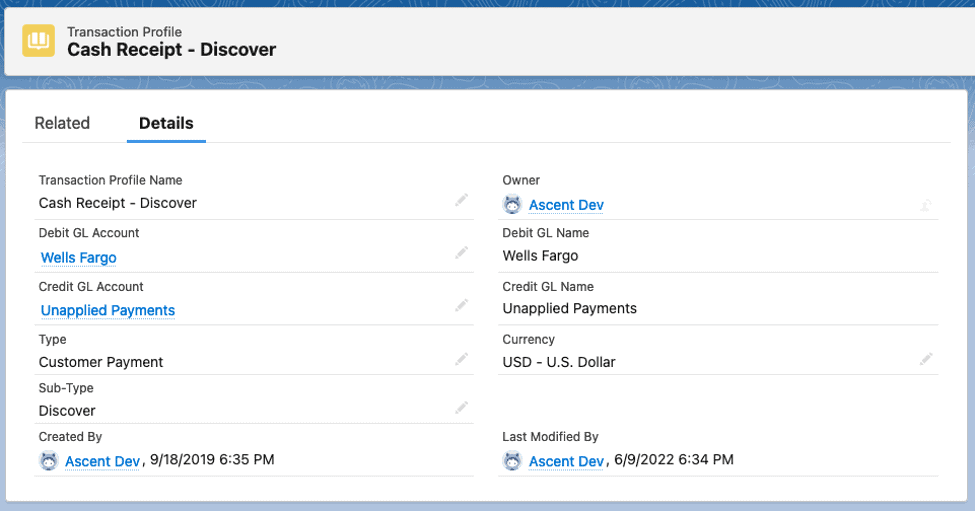

If it is for any other, this one may be chosen:

Hierarchy: there is a hierarchy that Ascent follows when selecting general ledger accounts for journal entry creation.

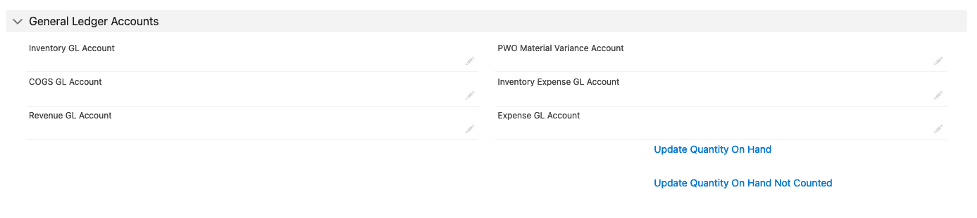

For any inventory related transactions (the General Ledger Accounts section) – note that these fields are optional. They can be left blank, and the system will then go looking in the Item Group record associated with this Item Master for general ledger accounts.

- Item Master

Inventory GL Account: AFP will use this account when material is received or when it is shipped, to deduct the value of that material

COGS GL Account: this is the cost of good sold account, which would be debited when material is sold to a customer

Revenue GL Account: this is a sales account, which would be credited when material is shipped to a customer

PWO Material Variance Account: this account gets updated with the value above/below the standard cost of the manufactured item. For example, if the standard cost of an item completed on a production work order is $100.00, however, the sum of the cost of the material consumed is $105.00, then this account would be debited for $5.00, the difference between the standard cost and the sum of the components.

Inventory Expense Account: this account gets used when performing a cycle count / count journal. If the cycle count line reduces inventory, then this account gets debited. If it increases inventory, this account gets credited.

Expense GL Account: this field does not get used. Inventory adjustments use the Expense GL Account residing on the Transaction Profile for Inventory Adjustments – ADD and Inventory Adjustments – SUB.

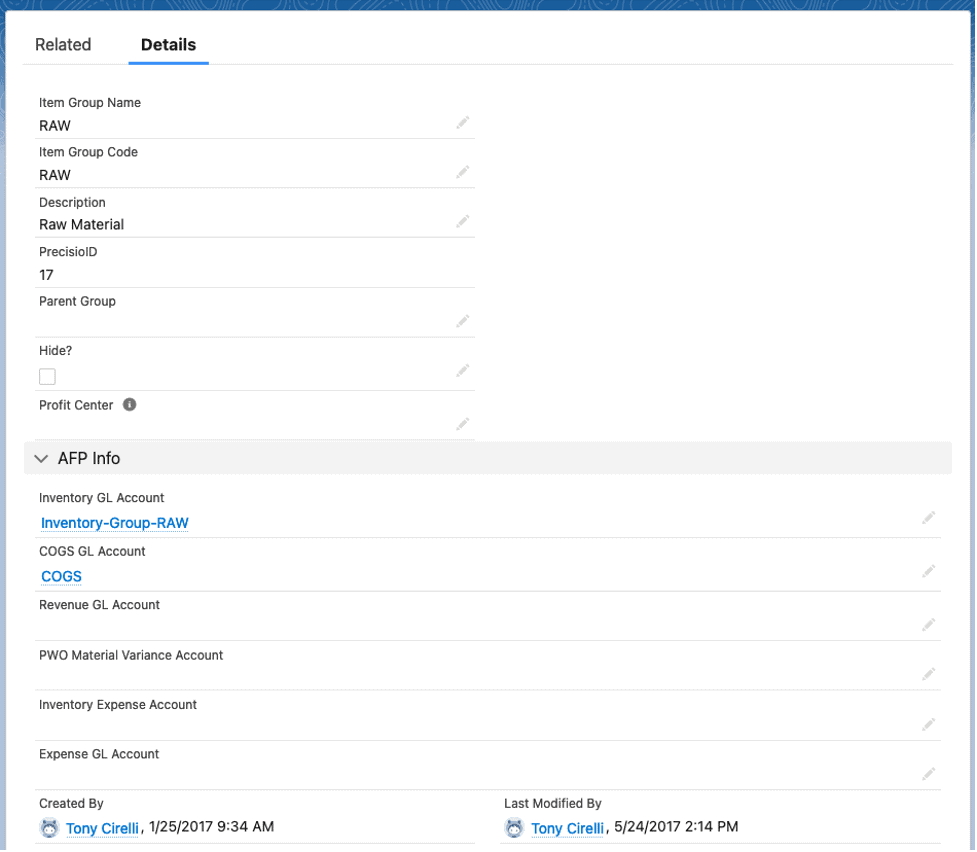

- Item Group

Item Group Name: This field is a brief description of the item group.

Item Group Code: This field is a 2 or 3 character field that the system uses as a key to differentiate it from other similarly spelled Item Group Names.

Description: Here, you can enter a more verbose description of the item group.

Profit Center: This field is a lookup field to a Profit Center object. Ascent does not use this field internally, however clients can use this for their own purposes.

Precisio ID: This field is automatically assigned to the Item Group by Ascent/Salesforce, and is not enterable.

Currency: You may enter the currency of the item group here.

Parent Group: You can create a relationship between an item group and a higher level item group. For example, the screen shot above shows item group Computer as having a Parent Group equal to Electronics. That Electronics item group can also have in its hierarchy item groups such as Audio Systems, Digital Clocks, and the like. When in a sales or purchase order, a user can start with an item group, and then have the next item group level displayed too.

Hide: When an item group has this field checked, it will not appear when the user clicks “Add Lines by Group” on a sales order, purchase order, opportunity, or quote.

The AFP Info area is specifically to identify general ledger accounts that are used by AFP for the purpose of creating journal entries.

Inventory GL Account: AFP will use this account when material is received or when it is shipped, to deduct the value of that material

COGS GL Account: this is the cost of good sold account, which would be debited when material is sold to a customer

Revenue GL Account: this is a sales account, which would be credited when material is shipped to a customer

PWO Material Variance Account: this account gets updated with the value above/below the standard cost of the manufactured item. For example, if the standard cost of an item completed on a production work order is $100.00, however, the sum of the cost of the material consumed is $105.00, then this account would be debited for $5.00, the difference between the standard cost and the sum of the components.

Inventory Expense Account: this account gets used when performing a cycle count / count journal. If the cycle count line reduces inventory, then this account gets debited. If it increases inventory, this account gets credited.

Expense GL Account: this field does not get used. Inventory adjustments use the Expense GL Account residing on the Transaction Profile for Inventory Adjustments – ADD and Inventory Adjustments – SUB.

- Transaction Profile – we saw several examples of transaction profiles above.

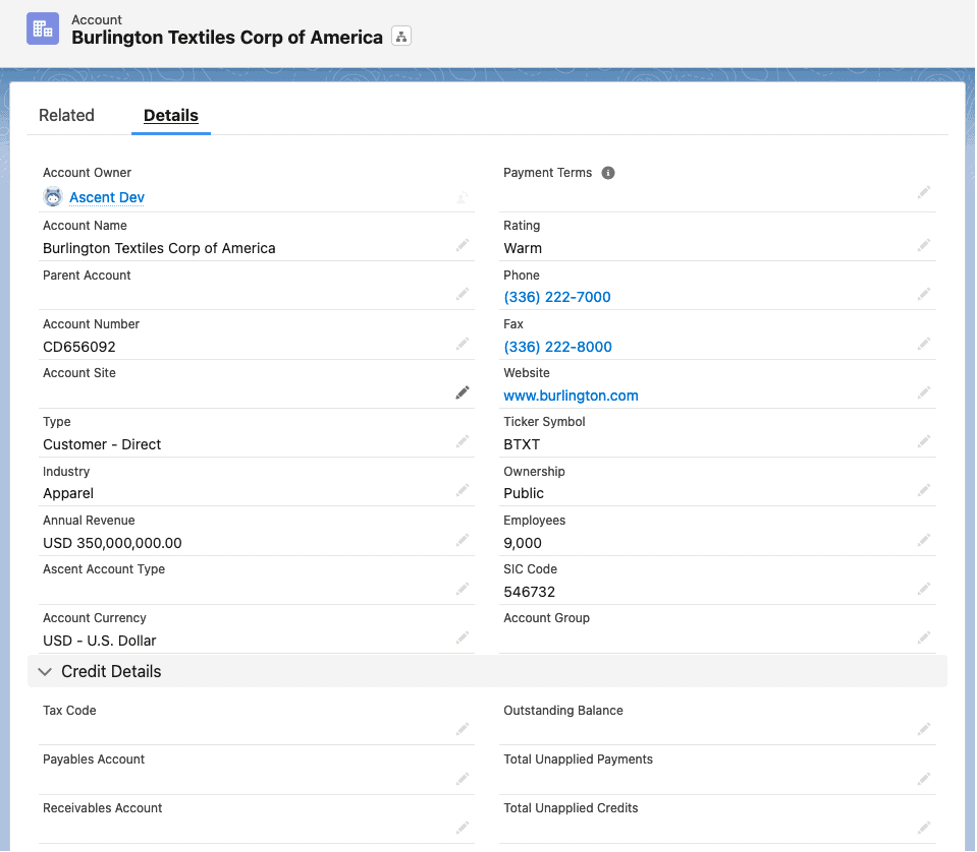

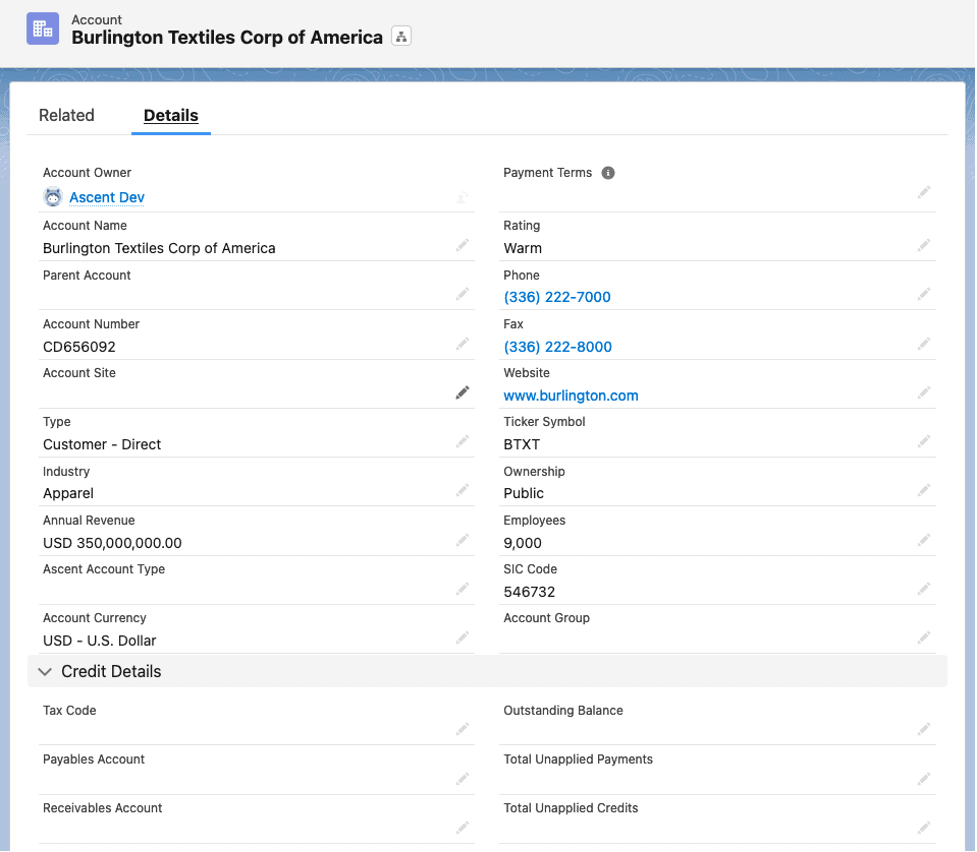

For sales (accounts receivable) transactions:

- Account – look for the Receivables Account. This would be the credit when invoicing.

- Transaction Profile – the accounts receivable account would come from here if there isn’t one on the Account object. Additionally, if there is no Sales Revenue account on the Item Group record, the Credit GL Account would come from here.

For purchasing (accounts payable) transactions:

For purchasing (accounts payable) transactions:

- Account – look for the Payables Account

- Transaction Profile – the accounts payable account would come from here if there isn’t one on the Account object.

- Account – look for the Payables Account

The remainder of this document will detail out other transaction profiles.

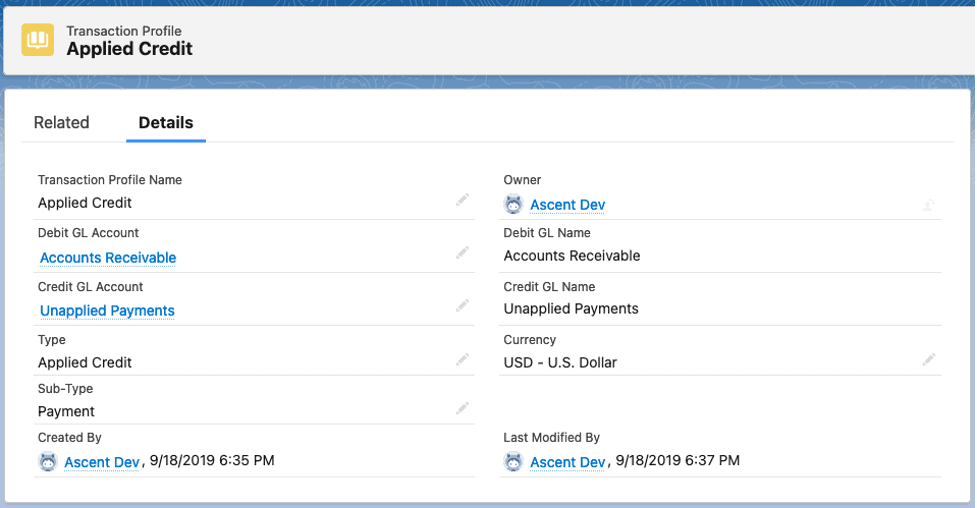

Applied Credit – this would be used when you apply a credit card payment, for example, to an open invoice. Payment is the only available sub-type.

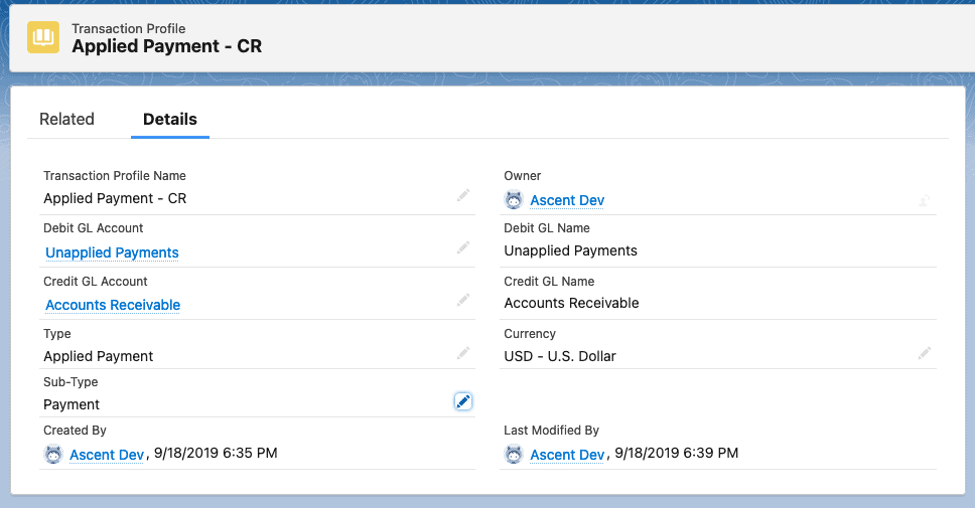

Applied Payment – CR – this is used to apply a cash payment.

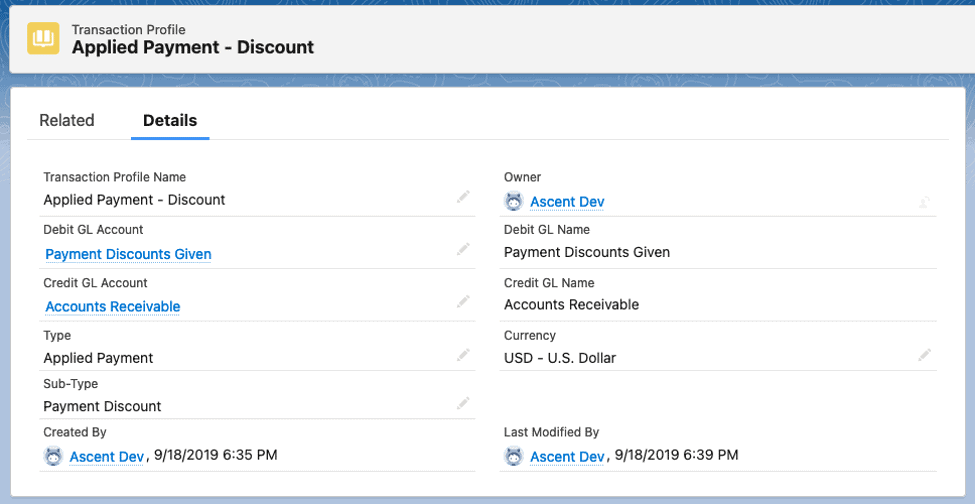

Applied Payment – Discount – this gets used when you are applying a cash payment and also have a cash discount to contend with.

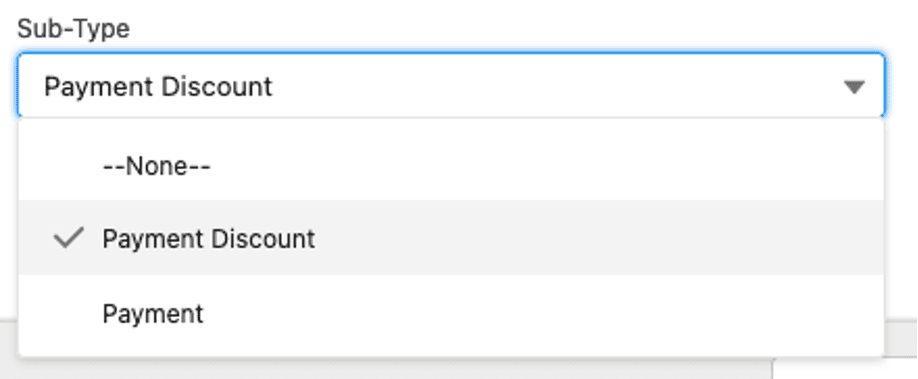

Notice the sub-types – it can be either payment or payment discount. Hence the need for two transaction profiles to apply payment.

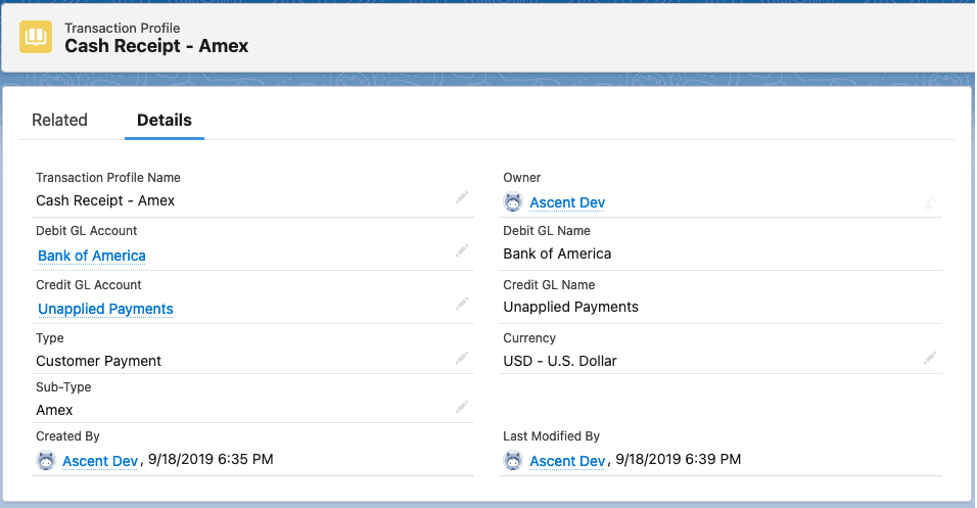

Cash Receipt – Amex – this one is the actual cash receipt transaction profile. The example is for posting cash via American Express.

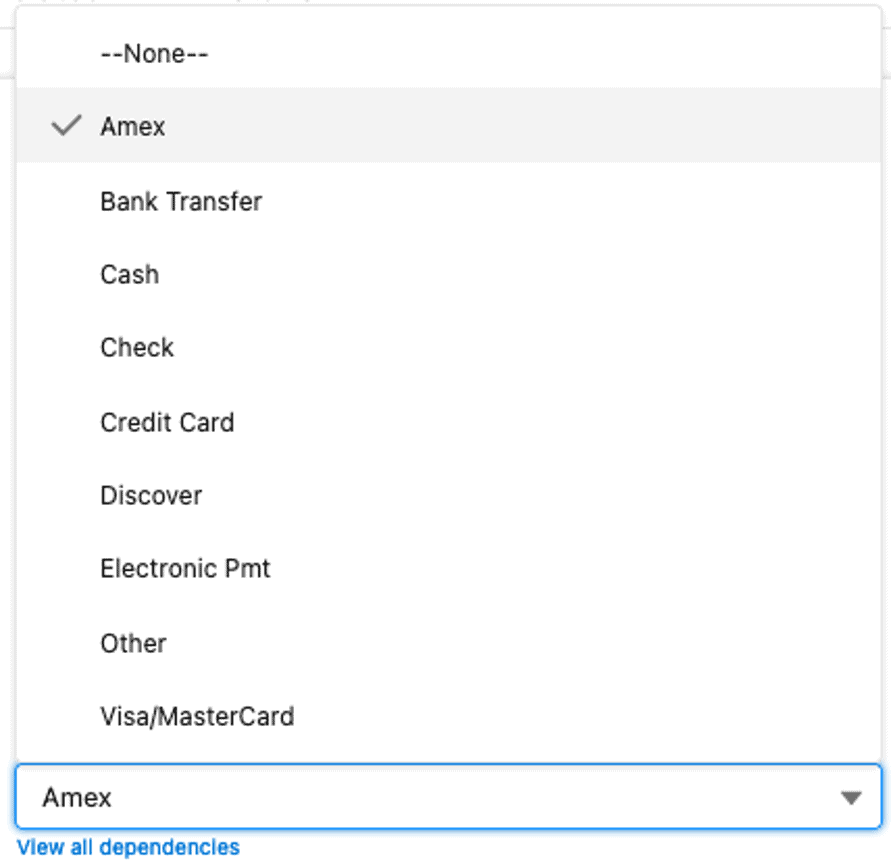

Rather than showing all of the available Sub-Types as separate Transaction Profiles, the following display shows those that are available for this Type:

You are not limited to these sub-types. This document won’t describe how to add other sub-types. That will be described in another document.

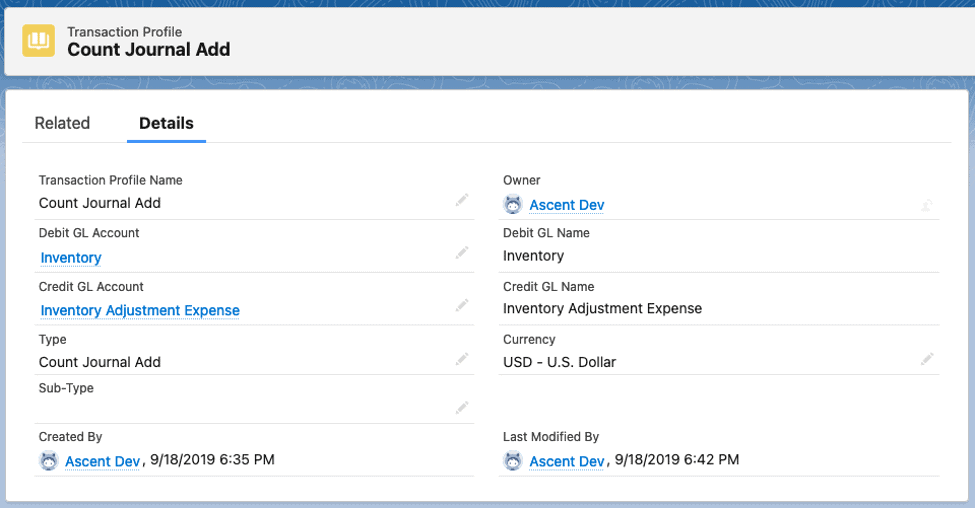

Count Journal Add – this transaction profile is used when you are performing a count journal and the individual line on the count journal and you are counting more than is in inventory at that location/lot/pallet.

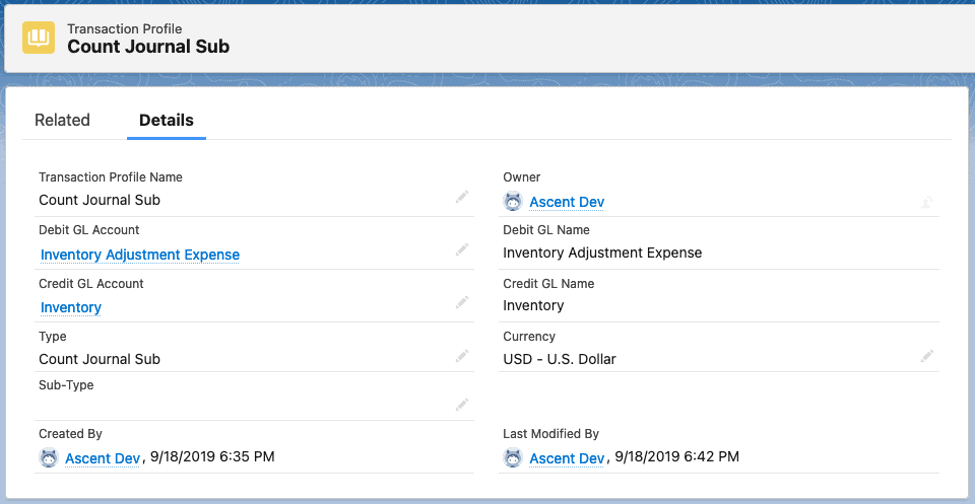

Count Journal Sub – this is used when you are performing a count journal and the individual line on the count journal and you are counting less than is in inventory at that location/lot/pallet.

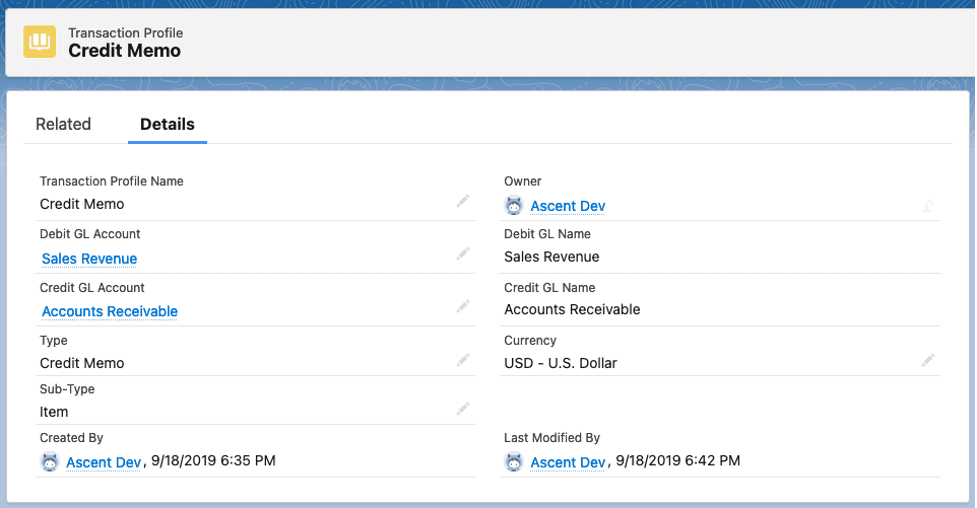

Credit Memo – if you’ve invoiced the goods, and a client wishes to return them, creating a credit memo is a method by which the invoice is no longer payable by the client. This translation profile handles the item being credited.

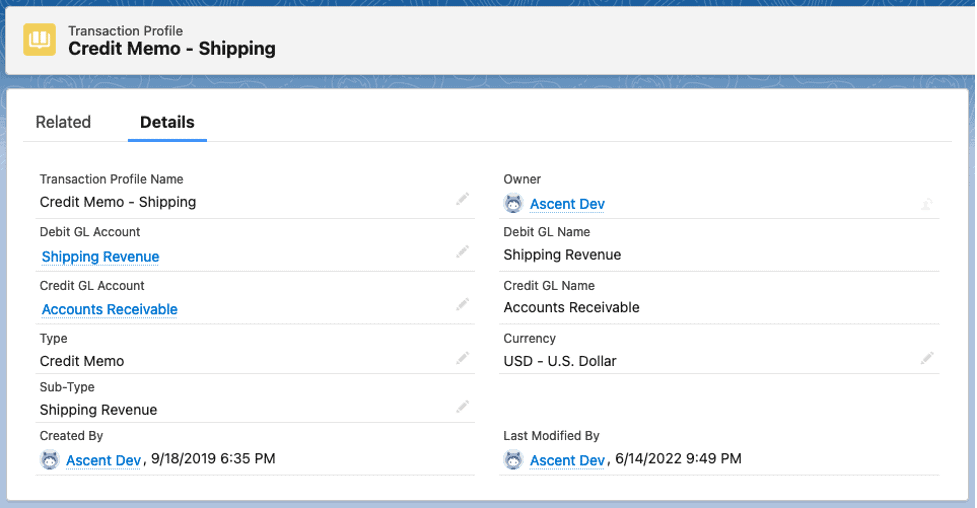

Credit Memo – Shipping – this transaction profile handles crediting the shipping charged.

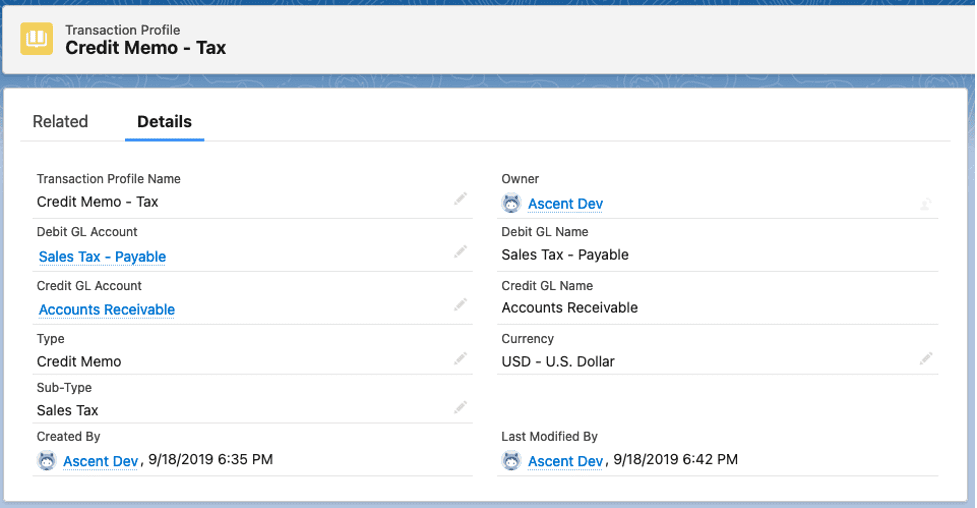

Credit Memo – Tax – and finally, this transaction profile handles the return of the sales tax.

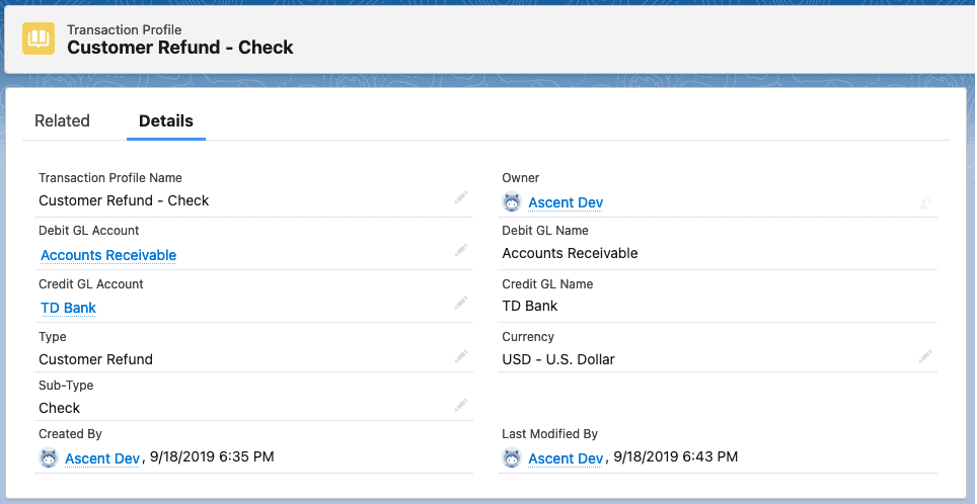

Customer Refund – Check – this would be used when you are giving the customer a refund, and writing a check to do that. The DR goes to A/R, and the CR goes to the bank account G/L account.

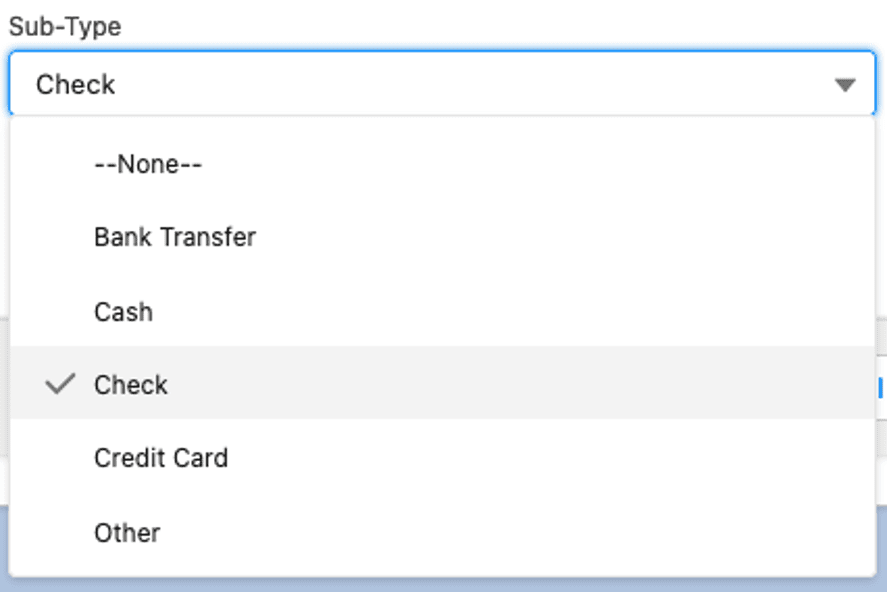

The sub-types you could use for Customer Refund are:

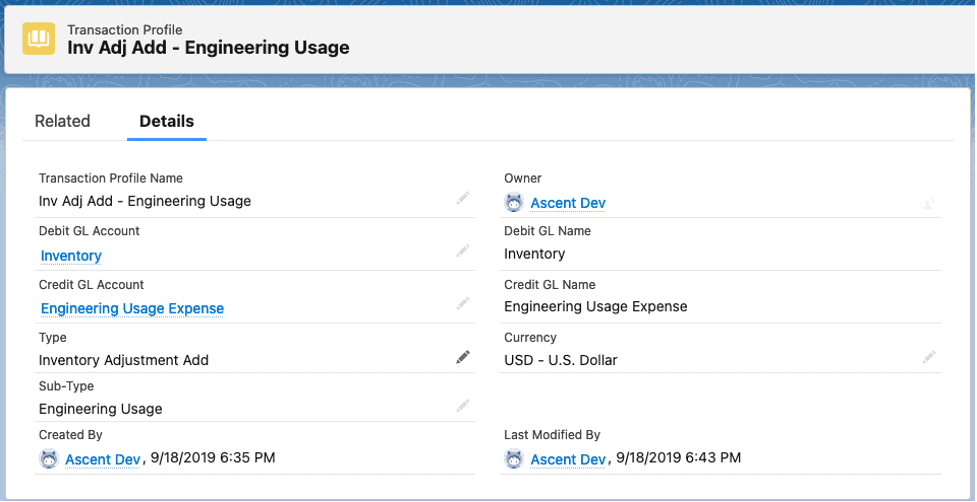

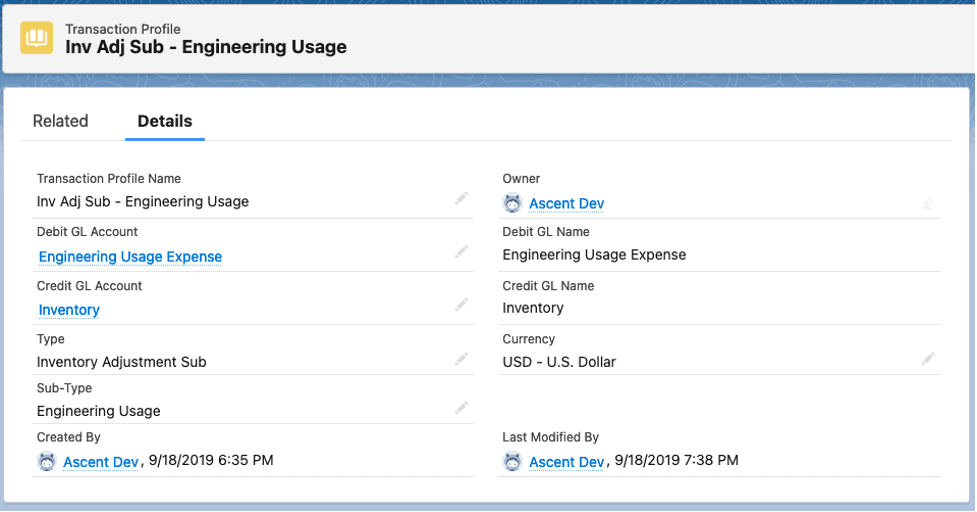

Inv Adj Add – this is used when you are on the item master screen and perform an inventory adjustment – add, and enter the Engineering Usage reason code. Of course, you will have to have previously created the sub-type for Engineering Usage.

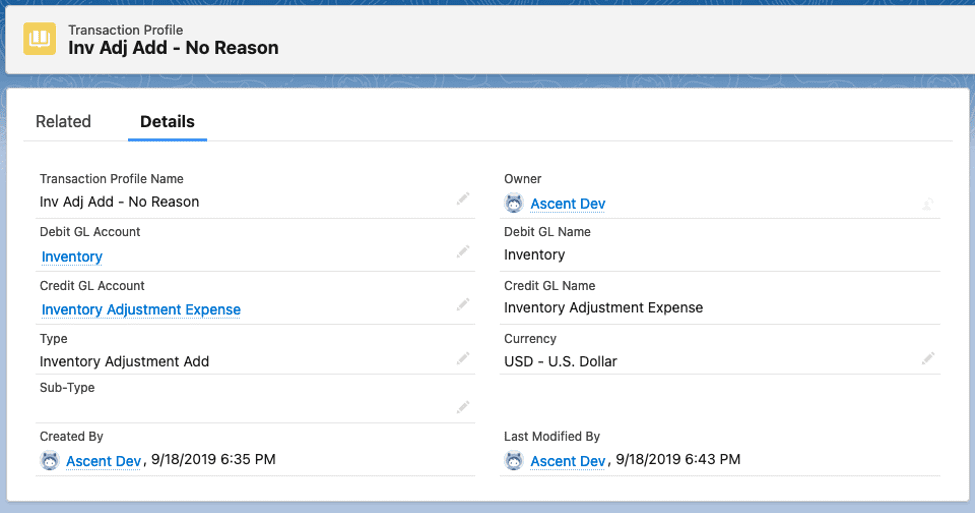

Now, if you don’t have any specific reason code to use for an inventory adjustment add transaction, you can simply not enter one, and have a transaction profile set for that.

Inv Adj Sub – this is used when you are on the item master screen and perform an inventory adjustment – sub, and enter the Engineering Usage reason code. Of course, you will have to have previously created the sub-type for Engineering Usage.

Now, if you don’t have any specific reason code to use for an inventory adjustment sub transaction, you can simply not enter one, and have a transaction profile set for that.

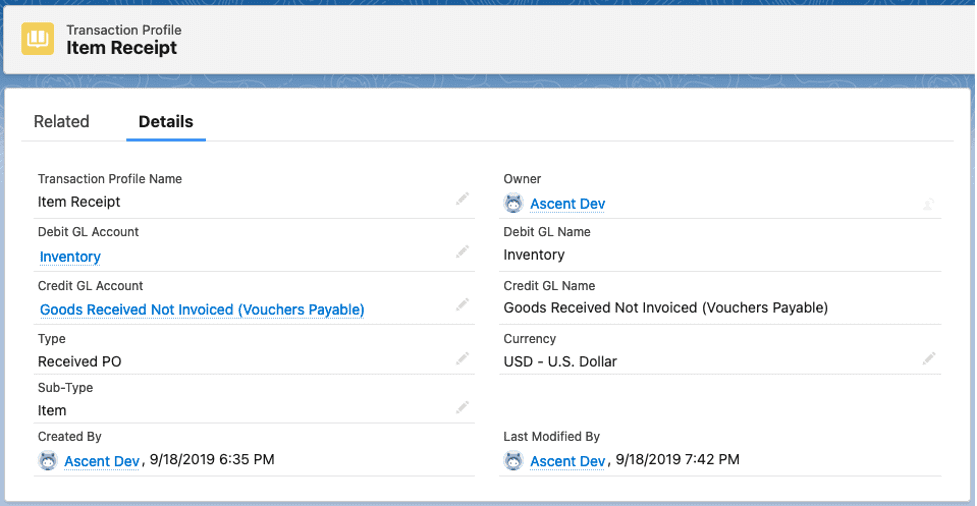

Item Receipt – this transaction profile is used when you receive a purchase order. The system will first attempt to look for an inventory account on the item master, and then look for one on the item’s item group, and if neither is successful, will use the Debit GL Account from the transaction profile.

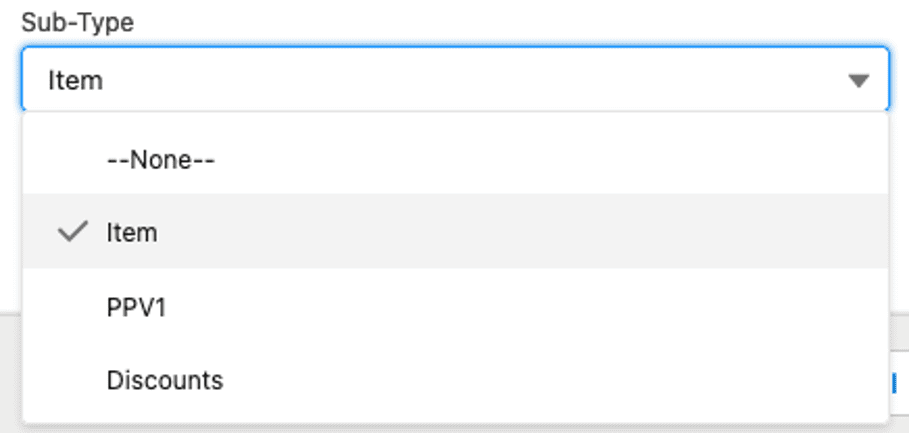

Received PO Type has multiple sub-types:

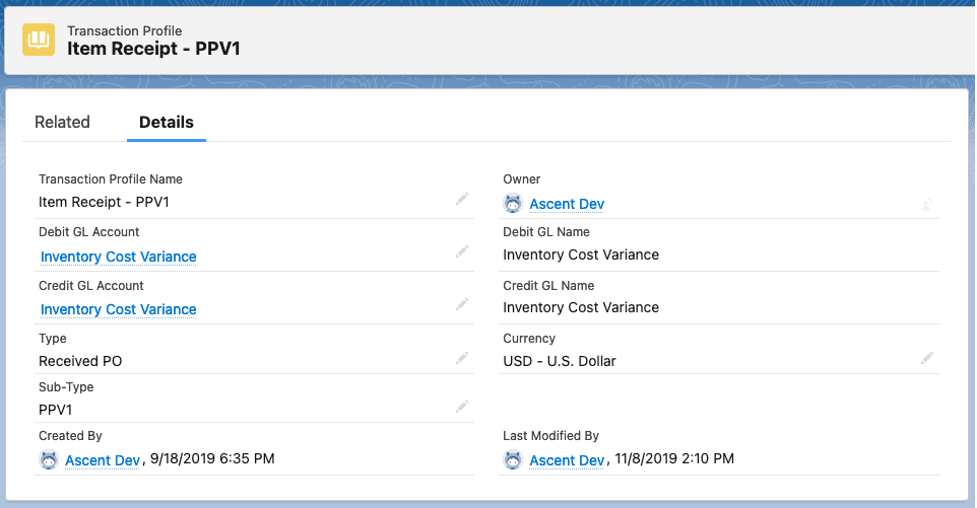

Item Receipt – PPV1 – this transaction profile would be used when you wish to record the purchase price variance between the item master cost and the purchase order price. Notice the Type is still Received PO, but the Sub-Type is PPV1. The DR and CR go to the same account, based on whether the PO price is higher than the item cost.

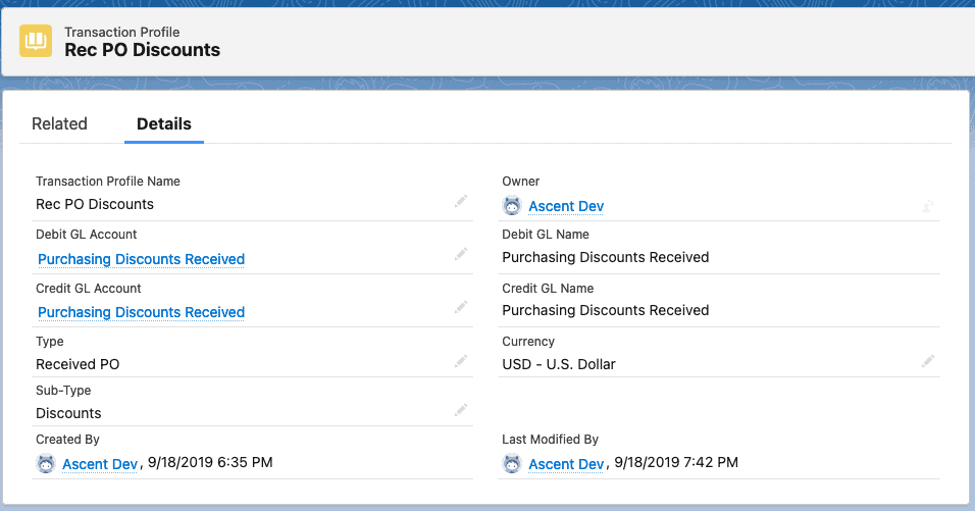

Rec PO Discounts – this transaction profile is used if there is a discount percentage entered on the PO line.

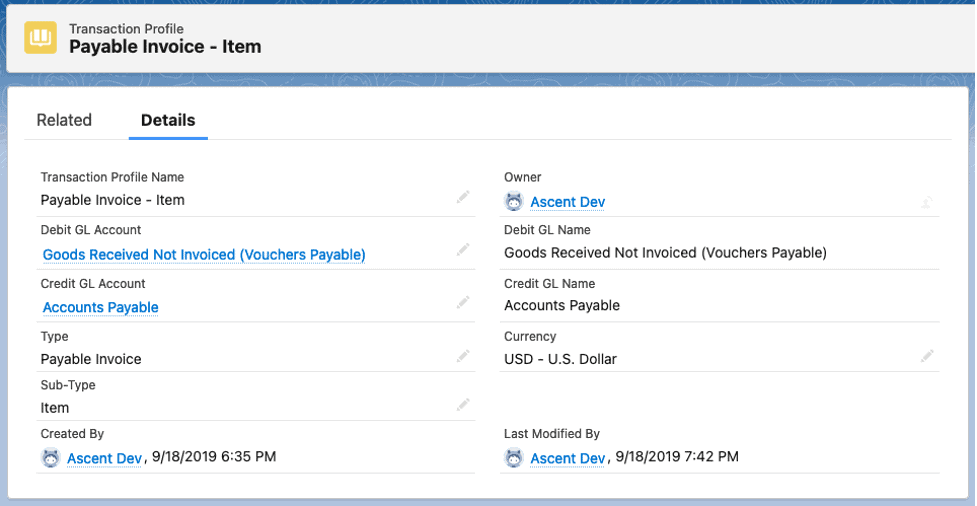

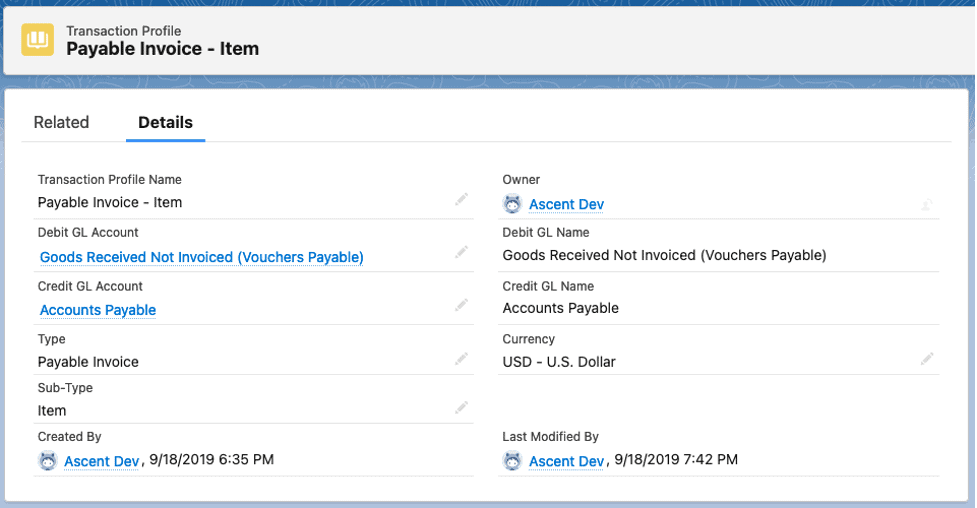

Payable Invoice – Item – this gets used when you match an A/P voucher to a purchase order.

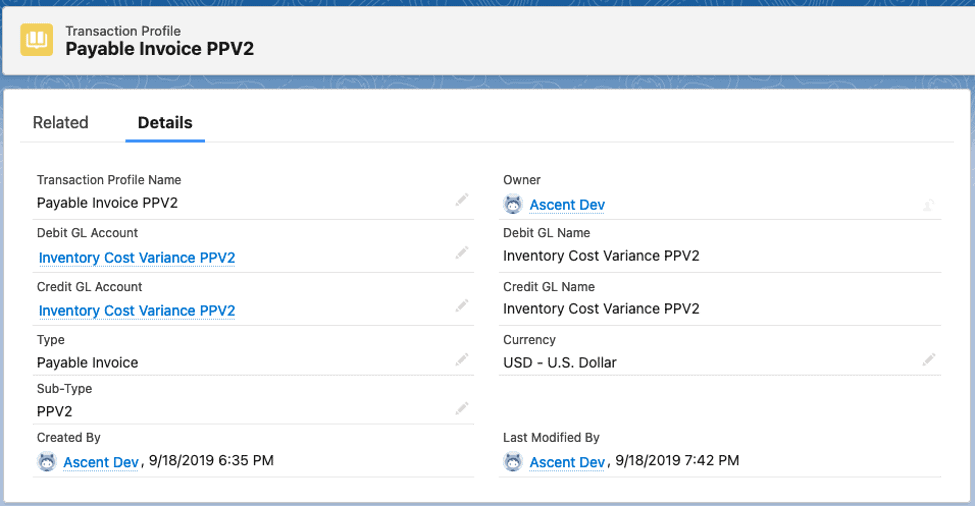

Payable Invoice Type has multiple sub-types, one for the item portion of the voucher/PO, and the other for variances in price between the PO and the voucher.

Payable Invoice – PPV2 – PPV2 is when the PO price is different than the voucher price.

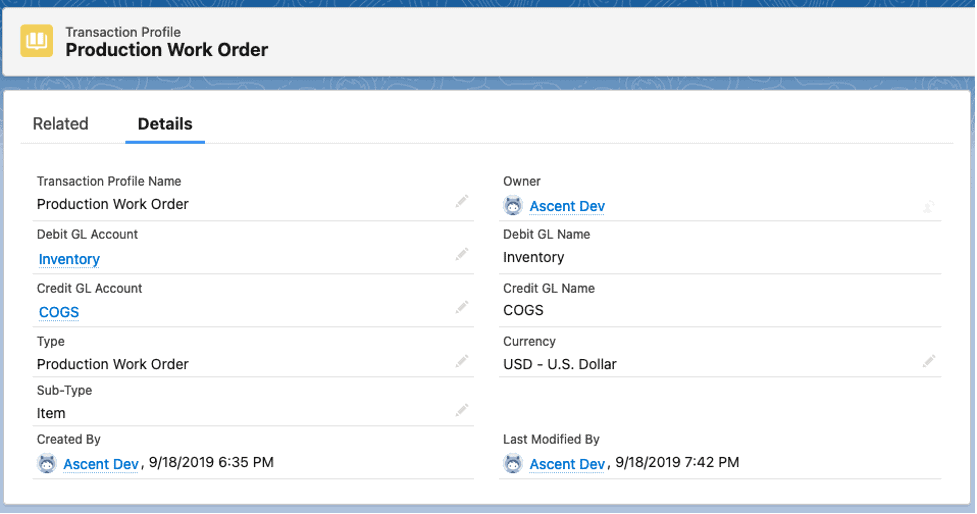

Production Work Order – this is the fallback position on any journals created by completing a production work order. Appropriate G/L posting accounts would come from the item or item group.

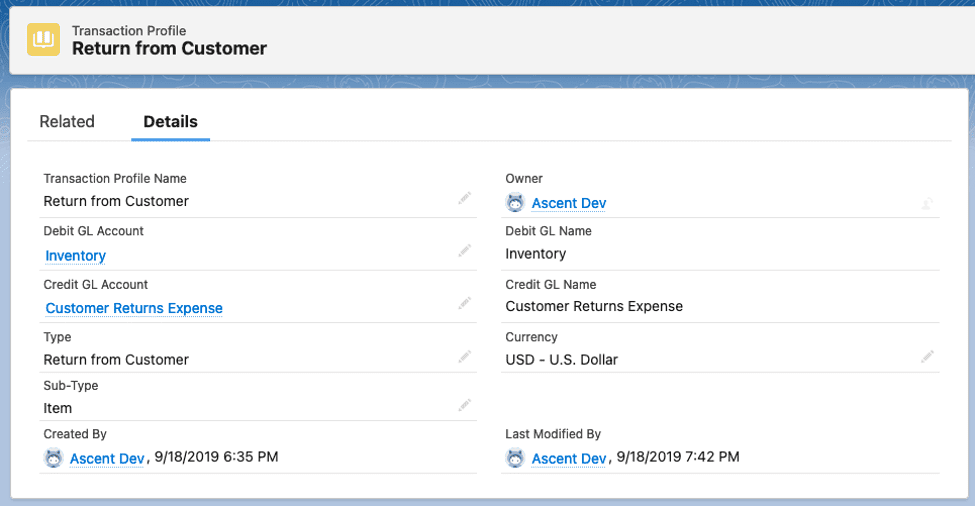

Return from Customer – this translation profile would be used when your company is using Return Lines rather than RMA Lines.

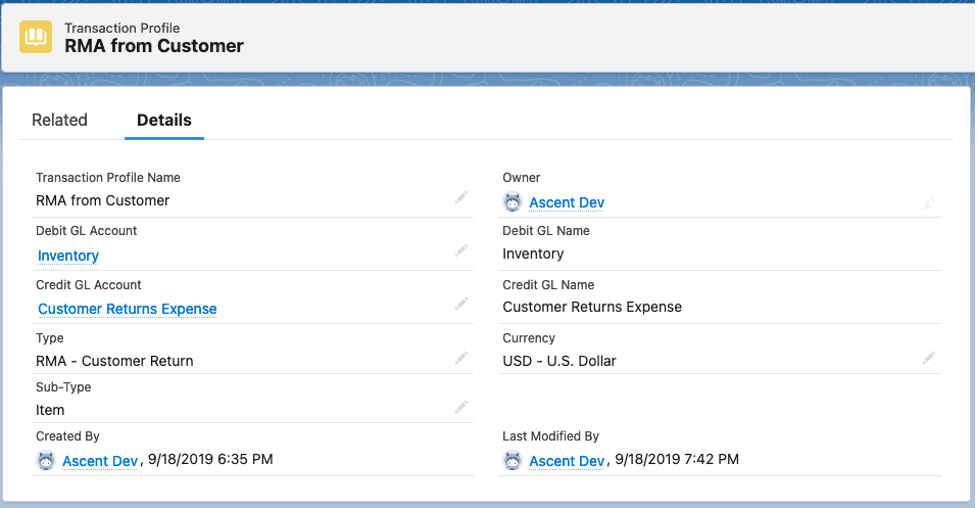

RMA from Customer – this translation profile would be used when your company is using RMA Lines rather than Return Lines.

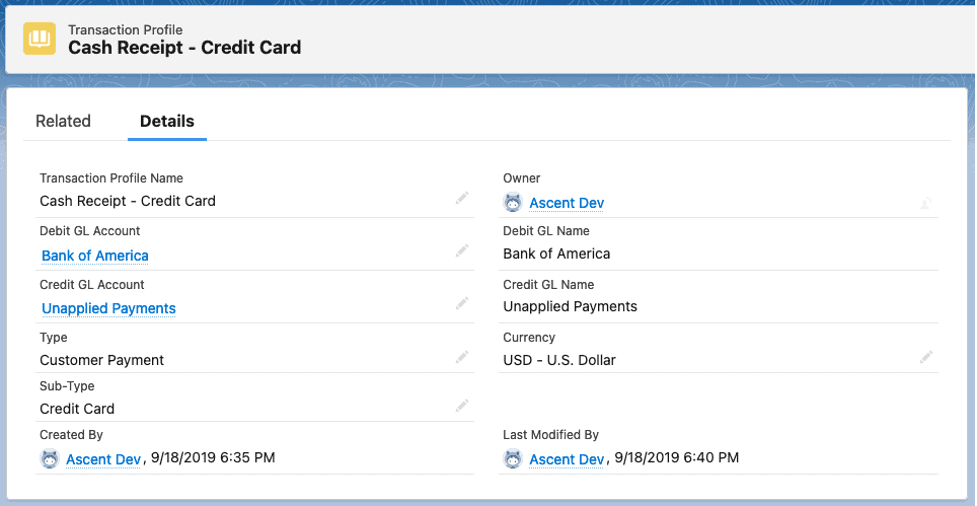

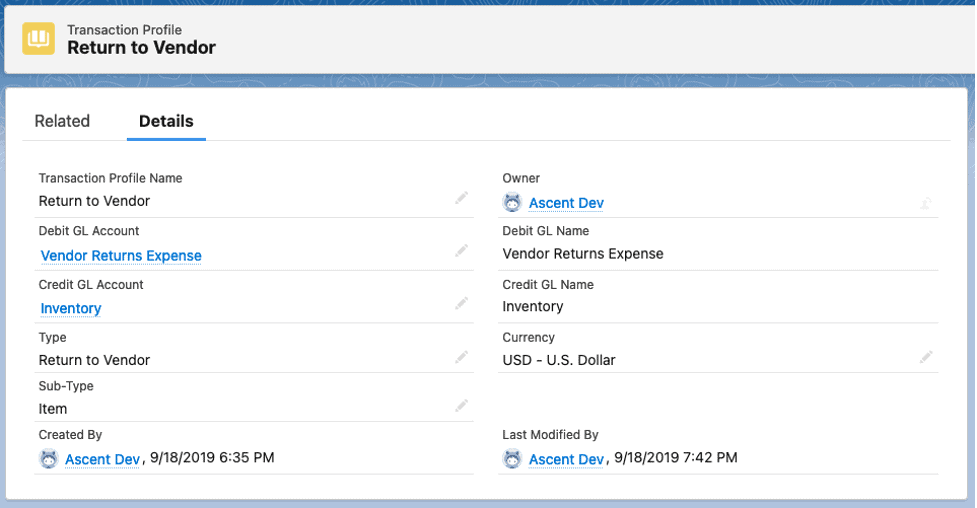

Return to Vendor – this translation profile would be used when your company is using Return Lines rather than RMA Lines.

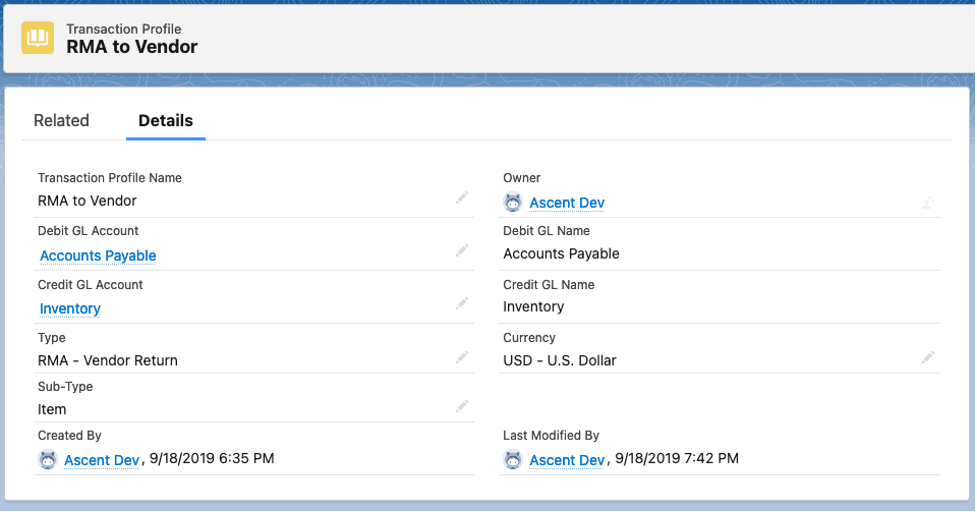

RMA to Vendor – this translation profile would be used when your company is using RMA Lines rather than Return Lines.

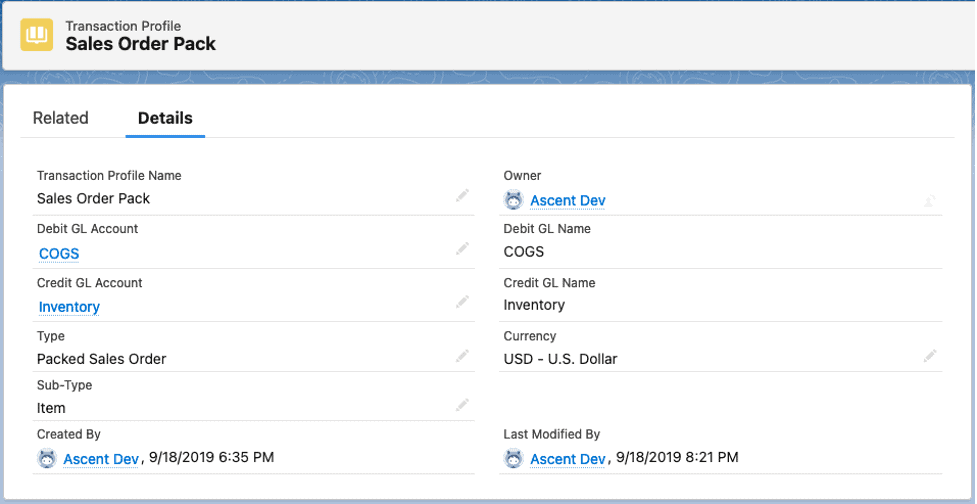

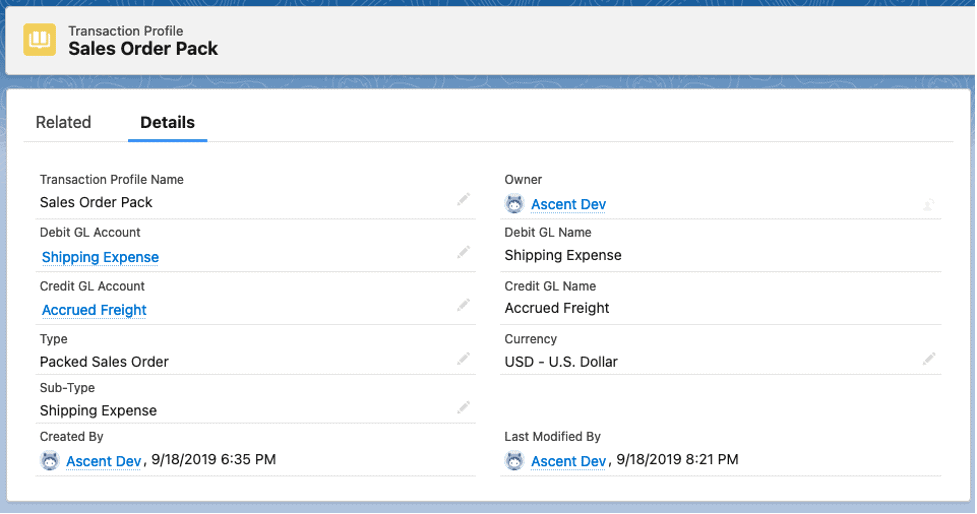

Sales Order Pack – this transaction profile is the last in line to be used when performing a PackSO

Type Packed Sales Order has two sub-types, one used for the actual line item being packed and the other used for any shipping expense.

Sales Order Pack (for Shipping Expense) – used if the field Actual Shipping Cost is not empty and the field Shipping Expense Journalized is not checked, a new JE line is created with the value = Actual Shipping Cost and using Transaction Profile with type = Packed Sales Order and subtype = Shipping Expense

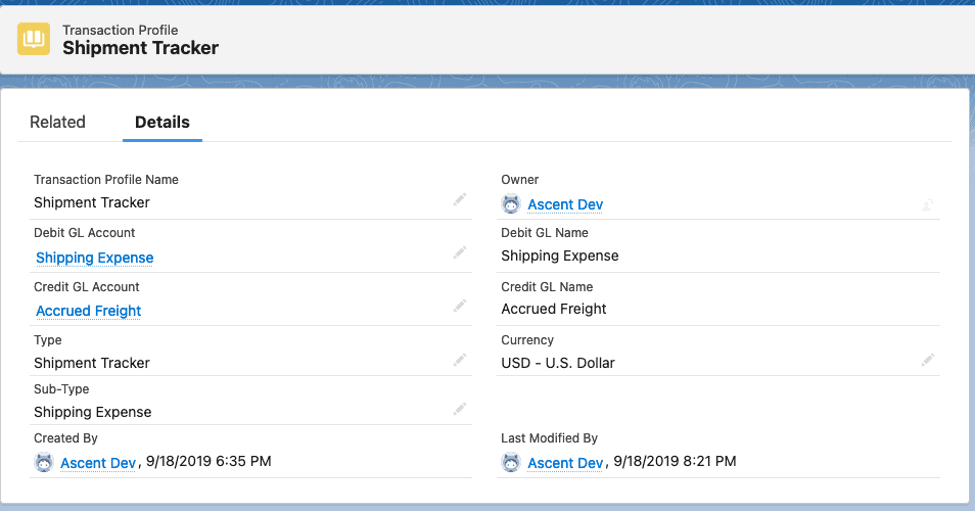

Shipment Tracker – this transaction profile is used when you create a carton (formerly known as shipment tracker), and the journal uses the value Total Shipment Cost from Carton.

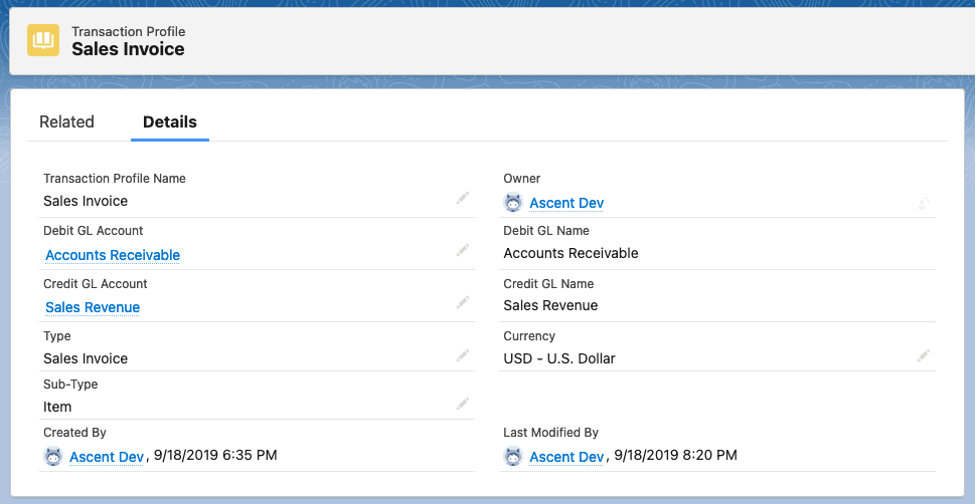

Sales Invoice – this transaction profile would be used as a last resort if there is no GL A/R account on the account or no Revenue GL account on the item master or on the Item Group.

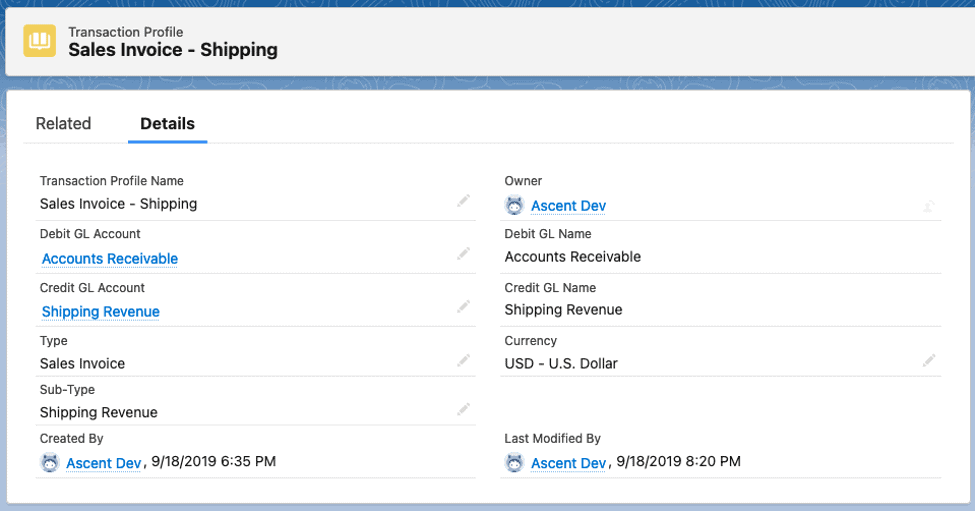

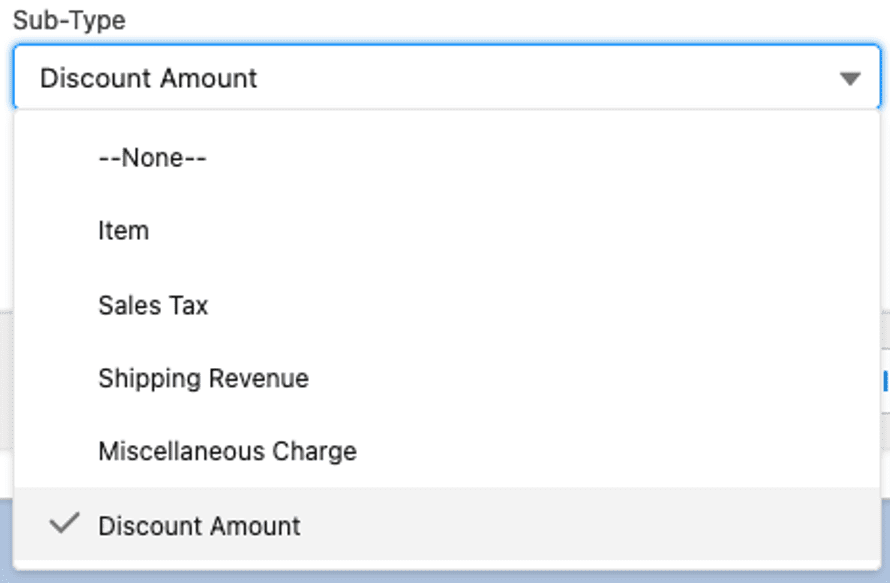

There are multiple Sub-Types associated with Type Sales Invoice:

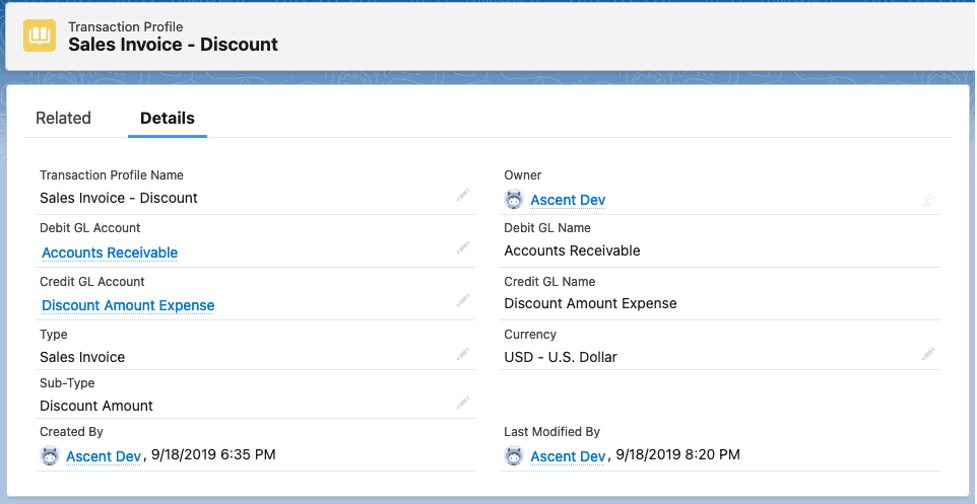

Sales Invoice – Discount – used for any sales discount on the invoice; sub-type is Discount Amount.

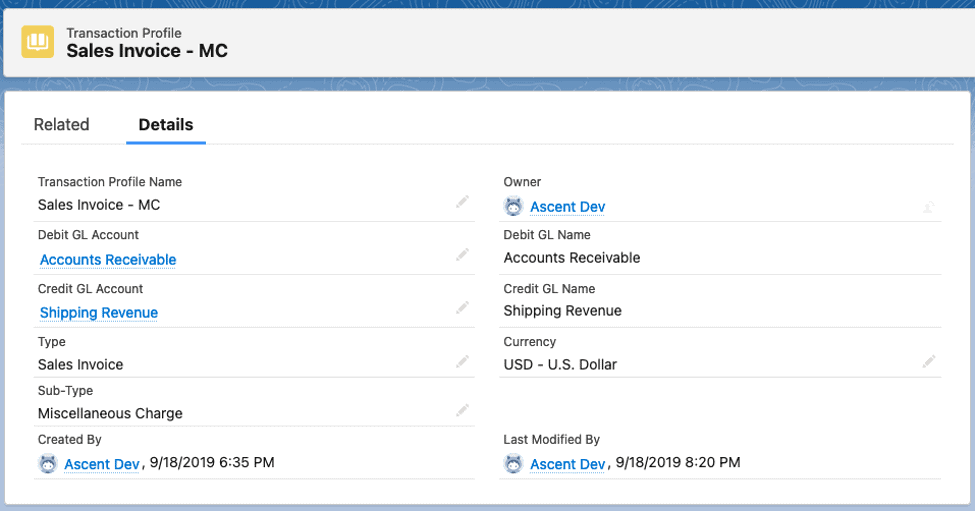

Sales Invoice – MC – used for any miscellaneous charges on the header of the invoice; sub-type is Miscellaneous Charge

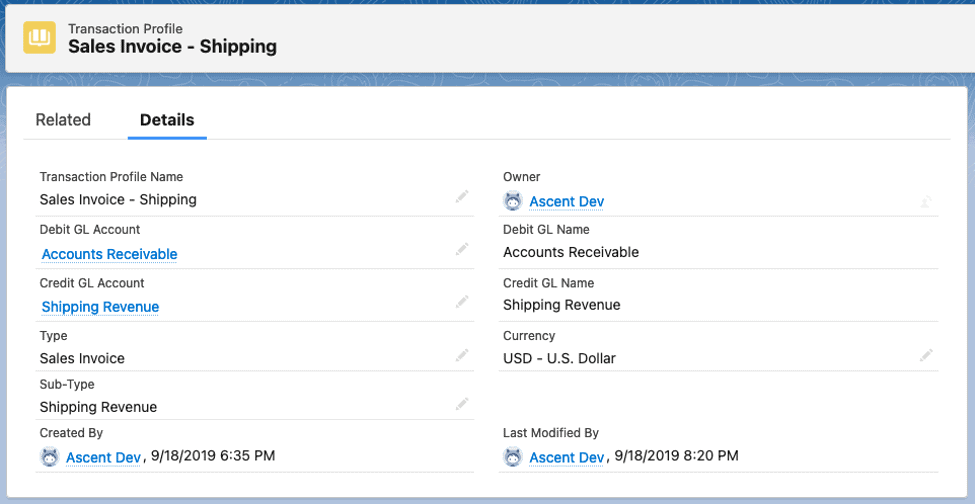

Sales Invoice – Shipping – this is used for Shipping Charged

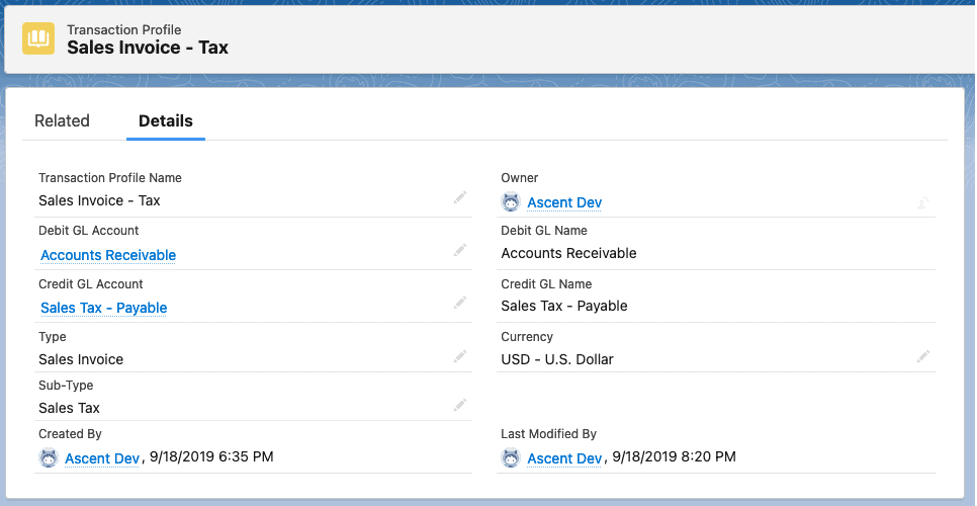

Sales Invoice – Tax – this is used to handle taxes that are on the invoice; sub-type is Sales Tax

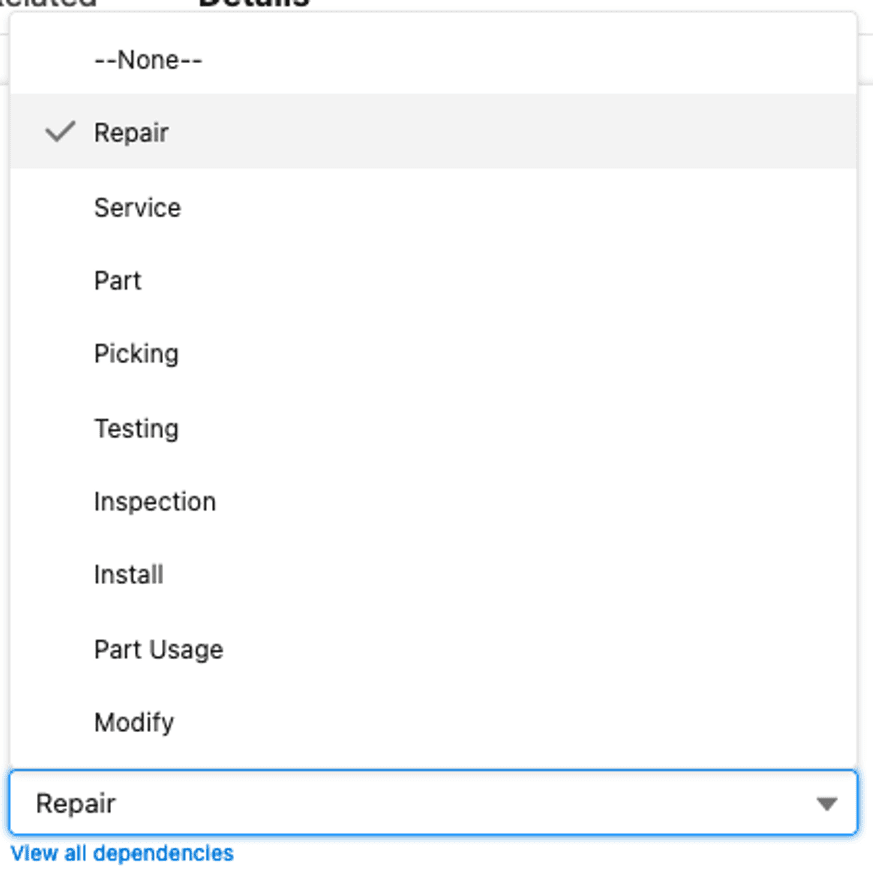

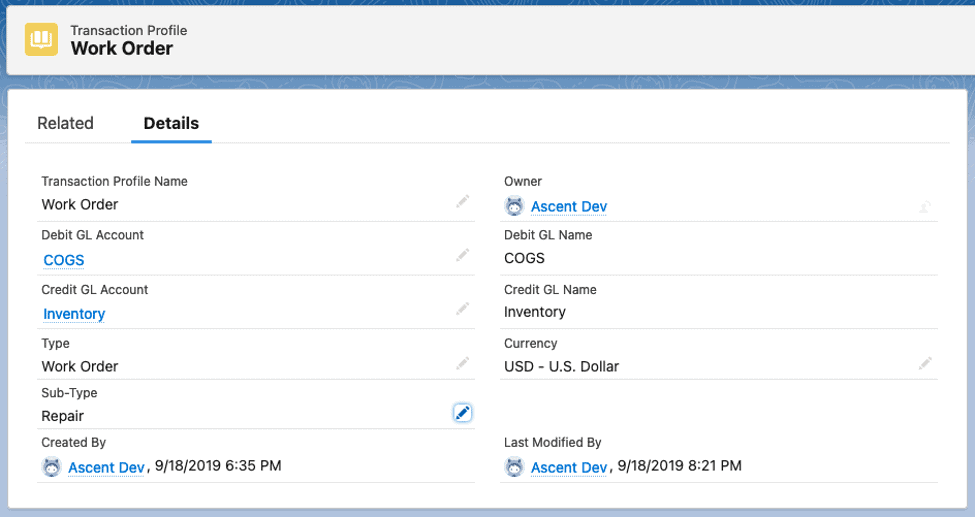

Work Orders – this transaction profile would be used when you have created a work order.

Inventory can be deducted or created, based on the response to two questions:

Consume Inventory? – checking this box will deduct from inventory.

Create Inventory? – checking this box will add to inventory.

Other sub-types available are: